“Investing is a business where you can look very silly for a long period of time before you are proven right.”

— Bill Ackman

Legendary investor Bill Ackman (Pershing Square Capital Management) was recently in the news for announcing that he has made a large investment in Uber – about $2.4 billion. That is now his largest portfolio position. He went all in. More about that below.

These are interesting times to be an investor. By many indicators, for example the Buffett indicator, the stock market in the US isn’t cheap anymore. (You can read more about the Buffett indicator in this article.) We saw a lot of defensive trades by legendary investors prior to the Presidential election in November 2024. Some legendary investors, like Warren Buffett, have even kept cash balances to be able to buy stocks at a discount if the market were to crash. (You can learn more about Warren Buffett's cash position in this recent article.)

On the other hand—and I am not trying to make a point for either political party—President Trump is seen by investors as very business-friendly, which should be a positive force for a continued bullish market. With a combination of bearish and bullish factors in the US stock market, which side will win out?

That is why it is interesting to see how legendary investors reacted in the quarter following the Presidential election, as reflected in their quarterly SEC filings as of December 31, 2024.

By US federal law, institutional investment managers in the US who manage at least $100 million in equity assets under management (AUM) are required to file SEC Form 13F 45 days after each quarter end with the Securities and Exchange Commission (SEC). That means that the reports as of the end of December 2024 are now available. See below for a detailed look at Bill Ackman’s 13F report.

Beyond the quarterly report as of December 31, 2024 and Bill Ackman's recent announcement relating to Uber, Bill Ackman also announced some further interesting portfolio changes in his annual investor update, that were not part of the 13F report filed with the SEC.

I will be discussing all of these in the following 4 sections:

A Detailed Look at the Portfolio Changes From Last Quarter

New Stock Purchases and Big Increases

Stocks Sold and Big Decreases

Key Insights for Your Own Investments

Let's take a closer look.

1. A Detailed Look at the Portfolio Changes from Last Quarter

Changes as of December 31, 2024 vs. September 30, 2024

Since the last quarterly filing as of September 30, 2024, much has changed with Bill Ackman’s Pershing Square Capital Management portfolio. There are the reported changes as of December 31, 2024 versus September 30, 2024 – and this is what I will be focusing on first. Then there are the changes he made after December 31, 2024, which I cover further below.

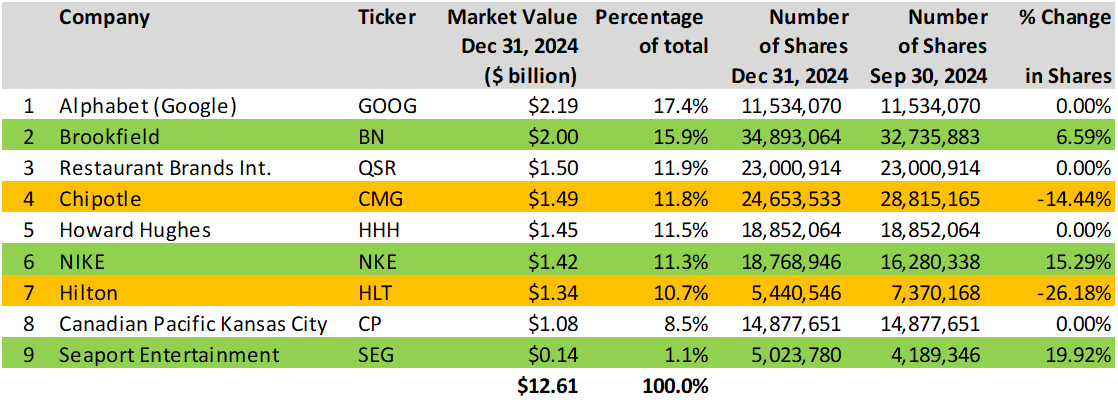

The companies highlighted in green show significant increases. The companies highlighted in orange show significant decreases. In a nutshell, as of December 31, 2024, Bill Ackman had 9 investments. Of those, compared to September 30, 2024, 3 investments were increased (Brookfield, Nike, and Seaport), and 2 investments were decreased (Chipotle and Hilton). The remaining 4 companies remained unchanged (Google, Restaurant Brands, Howard Hughes, and Canadian Pacific Kansas City).

Portfolio as of December 31, 2024 compared to September 30, 2024

Data source: https://www.sec.gov/edgar/browse/?CIK=1336528

Changes since December 31, 2024 - Uber

On February 7, 2025, Bill Ackman announced on X that he had been buying Uber since early January 2025, and now owns 30.3 million shares of Uber. As of February 14, 2025, Uber is trading at about $79.42, which values his Uber position at about $2.40 billion (30.3 million shares times $79.42 = $2.40 billion). Assuming nothing else has changed since December 31, 2024, this makes Uber Bill Ackman’s largest position.

Source: https://x.com/BillAckman/status/1887900916734738888

Changes since December 31, 2024 – Nike

Per the December 31, 2024 portfolio report (see above), Nike was Bill Ackman’s 6th largest position with a market value of roughly $1.42 billion as of December 31, 2024. In his annual investor presentation report, Bill Ackman mentioned that he converted the Nike equity position to deep in-the-money call options to free up capital while preserving the upside potential of Nike.

This means in early 2025, he sold the Nike holdings that were reported in his quarterly report as of December 31, 2024 (see above) and does not own the Nike stocks anymore. Instead he now owns deep, in-the-money call options for Nike.

Maybe, and this is just my speculation, that was done to help fund the $2.4 billion purchase of Uber stocks mentioned above.

Source: https://assets.pershingsquareholdings.com/2025/02/11095543/2025-Annual-Investor-Presentation.pdf

On a side note, if you are interested in the option aspect of trading, buying deep in-the-money call options instead of equity has a few advantages and disadvantages. The disadvantages are beyond the scope of this article. The major advantages, to explain Bill Ackman's actions, are:

Less Capital Required: Deep in-the-money call options require significantly less capital than purchasing the underlying stock. Deep in-the-money call options are expensive, but less capital-intensive than owning the underlying shares. They move 1:1 with the stock price increase, something that is not true with cheaper, out-of-the-money options.

Reduced Downside Risk: Investing in deep in-the-money call options limits the potential loss, as the loss is limited to the premium paid for the options.

Higher Leverage: Deep in-the-money call options have a delta close to 1.00, meaning they move almost in lockstep with the underlying asset's price. This high sensitivity allows investors to benefit from price increases while committing less capital upfront.

2. New Stock Purchases and Big Increases

I will be covering Ackman’s four stock holdings: Uber, a new investment that was added in early 2025 and is now Bill Ackman’s largest investment, and Brookfield, Nike, and Seaport, in which Ackman had increased his positions as of the last quarterly report (December 31, 2024).

Uber (UBER) is now Ackman’s largest investment with $2.4 billion. This is a new position and was added AFTER the last quarterly portfolio report as of December 31, 2024.

Here is what Bill Ackman said about Uber:

“World’s leading rideshare (mobility) and delivery (Uber Eats). We believe the long-term risk from autonomous vehicles (AVs) is limited and estimate that Uber’s share price is likely to more than double over the next 3 to 4 years.”

Brookfield (BN), an alternative asset manager, grew by 6.59% in terms of shares.

Brookfield is a massive alternative asset management company that specializes in alternative investments like private equity, real estate, hedge funds, infrastructure, and commodities. Brookfield is discussed a bit more in detail in this last article about Bill Ackman’s investments.

Here is what Bill Ackman said about Brookfield:

“Leading alternative asset manager with high-quality and rapidly growing cash flows trading at a significant discount to intrinsic value. Leading global alternative asset manager with deep domain expertise.”

Nike (NKE) grew by 15.29% in terms of shares.

Here is what Bill Ackman said about Nike:

“NIKE’s turnaround is in the early stages as new CEO Elliott Hill lays the foundations to drive sustainable, long-term growth. Market leader in the high-growth athletic footwear and apparel industry.”

Seaport Entertainment (SEG) grew by 19.92% in terms of shares.

Seaport Entertainment (SEG) was spun out of Howard Hughes (HHH) in July 2024. SEG operates entertainment and real estate assets, primarily in NYC and Las Vegas.

Source: https://assets.pershingsquareholdings.com/2025/02/11095543/2025-Annual-Investor-Presentation.pdf

Source: https://stockanalysis.com

3. Stocks Sold and Big Decreases

I will be covering Ackman’s two stock holdings: Chipotle and Hilton. These holdings were decreased as of the last quarterly report (December 31, 2024).

Chipotle (CMG) was reduced by 14.44% in terms of shares.

Although he reduced his Chipotle holdings, Bill Ackman seems to be still bullish on Chipotle. Here is what he said about Chipotle:

“Chipotle’s industry-leading value proposition continues to resonate with customers and drive outsized growth. Industry-leading financial performance in 2024. 2024 restaurant margin expansion of 50bps despite discrete headwinds from investments in portion consistency and California wage inflation. Chipotle’s industry-leading value proposition continues to resonate with customers and drive outsized growth”

Hilton (HLT) was reduced by 26.18% in terms of shares.

Likewise, despite the reduction, Bill Ackman still appears to be bullish on Hilton. Here is what Bill Ackman said about Hilton:

“Hilton is a high-quality business with a long runway of strong earnings growth led by an exceptional management team. Continued strong financial and operational performance in 2024. Pershing Square trimmed its holdings in HLT during 2024 given HLT’s strong share price performance and expanding valuation premium – HLT remains a core position”

Source: https://assets.pershingsquareholdings.com/2025/02/11095543/2025-Annual-Investor-Presentation.pdf

Source: https://stockanalysis.com

4. Key Insights for Your Own Investments

When I look at Bill Ackman's holdings, he seems to focus on companies that are leaders in their respective fields and that mostly target customers in the middle to upper-middle income brackets. This feels true when you look at some of his investments, like Uber, Nike, Hilton, and Chipotle. If true, that would mean that his working assumption is that the middle to upper-middle income groups will do well enough in the years to come, and the companies he picked have strong enough economic moats that they don’t have to fear competition undercutting their margins.

Take Chipotle as an example: Chipotle has been able to raise its prices significantly over the last couple of years.

If you are a customer of Chipotle, that is not great news. But as an investor, that is great news. That means that Chipotle has been able to pass on the rising prices to its customers – as the customers could afford it. So much so that Bill Ackman said, “2024 restaurant margin expansion of 50 bps despite discrete headwinds from investments in portion consistency and California wage inflation.” In other words – despite rising prices, Chipotle was able to increase its margin by 50 bps (0.50%). That is huge.

In a nutshell, Bill Ackman likely believes that strong companies with significant economic moats (like the ones he selected), catering to middle to upper-middle income customers, should do well in the years to come. Something to keep in mind as one thinks about where to invest.

Summary

Bill Ackman's Pershing Square Capital Management has made significant changes to its portfolio as discussed above. From Bill Ackman's investment actions, one can come to the conclusion that he is bullish on the companies with strong economic moats that cater to middle to upper-middle income customers.

Thank you for reading the article. Hope you enjoyed it.

Hungry for more? Subscribe to the newsletter - it's free and fabulous.Enjoyed this article? Don't keep it to yourself! Share it with a friend or two. They might even buy you a coffee as a thank you.Your Fringe Finance

Disclaimer

Neither the author nor Fringe Finance is a financial advisor or a tax professional. This article is for illustrative and educational purposes only and does not constitute a specific offer of any product or service.

Past performance of stocks and assets is not an indicator or guarantee of future performance of stocks and assets.

The information in this blog does not constitute an offer to buy or sell, or a solicitation of an offer to buy or sell, any of the securities mentioned herein.

We believe the information provided is accurate and current. However, we do not guarantee its accuracy and it should not be considered a complete analysis of the topics discussed.

Any opinions expressed reflect the author's judgment at the time of publication and are subject to change.

Seek guidance from qualified financial and tax experts before taking action.