Billionaire Chris Hohn Bets Big on AI

From Industrials to AI: Inside the Legendary Investor Hohn’s $43B Portfolio

This article is part of the Legendary Investor Series:

Turn $10,000 into $100,000 or more by following legendary investors like Buffett, Rogers, Burry, and more. Shortcut your journey to financial freedom!

“If you have more than 120 or 130 IQ points, you can afford to give the rest away. You don't need extraordinary intelligence to succeed as an investor."

— Warren Buffett

Whatever your ambition is in life – be it a football player, a pilot, a race car driver, or an investor – a great way to shortcut one’s learning curve and become an expert is to follow the experts in one field. In the field of investment, there are a number of legendary investors. Legendary investors are those who achieved superior performance over an extended period of time. Why is that important? Anyone can get lucky for a year or two. Being consistently exceptional over a long time is what it takes to become a legendary investor.

Some, like Warren Buffett, Jim Rogers, and Bill Ackman, have a very high public profile. Some, like Chris Hohn, have a lower public profile. In either case, they all are great role models for any investor.

Legendary investor Chris Hohn, the founder of TCI Fund Management, is renowned for his concentrated, high-conviction investment style and activist approach. Managing tens of billions of dollars, his moves are closely watched by investors worldwide. In the first quarter of 2025, Hohn’s portfolio underwent notable shifts that reveal his evolving views. Either way, Hohn continues to be very successful.

In March 2025, the Institutional Investor ranked Chris Hohn at number 8 in its annual ranking of worldwide hedge fund managers, after being part of that same list a year earlier. A great accomplishment.

Hohn’s approach underscores the importance of deep research and conviction; instead of spreading your capital across dozens of stocks, focus on a handful of high-quality companies with strong fundamentals, durable competitive advantages, and predictable cash flows. For any investor inspired by Hohn’s approach, the steps might be:

Identify 5–10 companies with strong moats—think businesses with unique advantages like brand power, network effects, or regulatory barriers.

Research their financials, management, and industry trends thoroughly.

Allocate a meaningful portion of your portfolio to these names, but ensure you understand the risks of concentration.

Enough said about Hohn’s approach. Let’s dive into his latest portfolio changes and what we can learn from them. In this article, I will be covering the following topics.

Trimming Winners: Hohn’s Play on Financial Giants Like Visa and Moody’s

Riding the AI Wave: Hohn Is Betting Big on AI

Hohn’s Q1 2025 Moves: Balancing Conviction and Caution

Fortifying with Infrastructure: Hohn’s Stability Play

Key Investment Insights for Individual Investors

1. Trimming Winners: Hohn’s Play on Financial Giants Like Visa and Moody’s

About 40% of Hohn’s portfolio is allocated to the financial sector. But not just the financial sector in general. Hohn concentrates his financial investments in three companies in the financial space with high economic moats: Visa, S&P, and Moody’s. Hohn uses these financial giants as a defensive core in TCI’s concentrated portfolio, balancing riskier bets.

Visa needs no introduction—it’s a global market titan with a strong economic moat, and is well known by consumers and investors alike. As of the latest filing, Hohn’s Visa position increased in value by over $500 million since December 2024 despite a small decrease in shares. This is because Visa’s share price increased by about 11% in 3 months (from 316 on 12/31/24 to 350 on 3/31/2025).

Moody’s and S&P are undisputed global leaders in the niche of credit rating services for governments and corporations. A quick way to think of these credit ratings is to see them as the corporate/government equivalent of the FICO score for individuals. While the name S&P is well known (e.g., as in S&P 500 Index), what the company actually does - and what its peer Moody’s does - is less well known. While there are other credit rating agencies out there, they pale in comparison to the might of S&P and Moody’s. The dominance of S&P and Moody’s is so compelling that if you’re a debt issuer (corporate or government) and choose to go with a lesser credit agency without involving at least one of these two giants, it raises eyebrows and sparks questions among savvy investors.

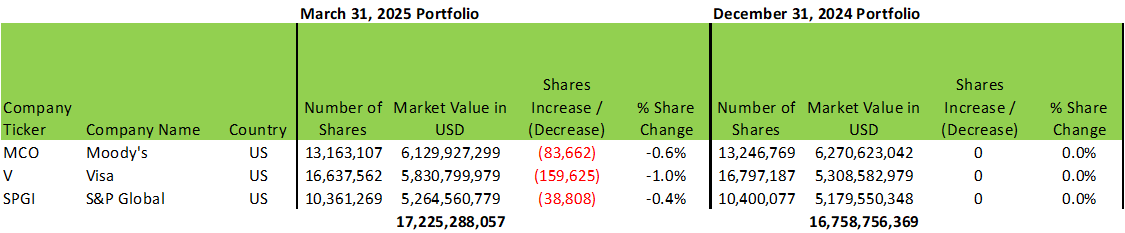

Hohn made small reductions in Q1 2025 in the financial sector holdings: Moody’s by 83,662 shares (-0.6%), Visa by 159,625 shares (-1.0%), and S&P Global by 38,808 shares (-0.4%). No changes occurred in Q4 2024 for these holdings.

Chris Hohn’s Portfolio & Changes – Finance Sector Only

Source: TCI Fund Management 13F SEC Filing

These minor trims suggest profit-taking after strong performance rather than a shift in conviction. Moody’s, Visa, and S&P Global benefit from durable moats in financial services—credit ratings, payment networks, and financial data, respectively. These companies generate stable cash flows, making them defensive anchors in TCI’s portfolio.

Hohn likely views financial services as a strong sector amid economic uncertainty. Visa’s dominance in digital payments aligns with the shift to cashless economies, while Moody’s and S&P Global benefit from growing demand for credit and financial data. The small trims suggest he’s comfortable with their current weightings but wants to free up capital for other opportunities.

Future Outlook for Hohn’s Financial Sector Strategy

Visa: Likely to gain from e-commerce expansion and emerging market adoption, though high valuations may prompt further trims by Hohn if growth slows.

Moody’s and S&P Global: Poised for steady revenue from debt issuance and data demand. Hohn may hold steady unless valuations exceed fundamentals.

Macro Context: If interest rates remain elevated or a recession looms, these companies’ defensive profiles will shine, justifying Hohn’s heavy weighting. However, he may trim further to fund tech bets if AI opportunities accelerate.

Lessons for Individual Investors

Hohn’s financial sector strategy offers actionable insights for retail investors:

Prioritize moats: Invest in companies with unassailable advantages, like Visa’s network effects or Moody’s regulatory moat.

Trim strategically: Take profits when valuations are stretched (above normal P/E ratios), but maintain core positions in quality companies. Use the proceeds to diversify into undervalued sectors.

Balance defense and growth: Use stable sectors (such as finance here) to anchor a portfolio, offsetting riskier bets.