China, depending on how you measure it, is the 2nd largest or largest economy of the world. China’s economy is 4 times that of Germany or Japan. Its manufacturing capacity is larger than that of the US and EU combined.

Legendary investor Michael Burry, famous for predicting the 2007 subprime crisis, has recently ramped up his investments in China significantly. More about that in next week’s article. The legendary investor Jim Rogers has been investing in China for a long time. Are you missing out?

If you don’t already know, get familiar with China’s Amazon, China’s eBay, China’s Tesla, and China’s Google; all massive corporations in their own right. China’s Amazon, JD.com, is the 47th largest company in the world. Read more about them below, including how to best invest in Chinese companies and successfully navigate risks.

The Transformation of China

Sometimes, when things change dramatically, it can be difficult to fully grasp how the world has changed. China is now the largest or second-largest economy in the world, depending on how you measure it, and it currently has double the manufacturing output of the U.S. Read more about that below. Statistics say a lot, but as the old saying goes, “A picture is worth a thousand words.” Here is a comparison of the Chinese city of Shanghai in 1987 versus today:

Manufacturing Powerhouse China

Manufacturing output refers to the total value of goods produced by a country's factories and industries. In simple terms, it includes all the products (cars, computers, etc.) that we can touch with our hands. According to the graph below, China’s industrial output is now about 30% of total world production, while the US is at about 15% and the EU is at about 14%.

In 2005, the combined output of the US and Europe was 40%, while China was at 10%. In just about 20 years, China has overtaken Japan, the EU, and the US, becoming number one in manufacturing output by a wide margin. Let’s pause here for a second, to acknowledge that whatever the future may bring, this was an amazing accomplishment by China.

Percentage Share of Global Manufacturing by Country/Area

Here is another global comparison from a few years earlier (2019) showing a different version of this trend: China is the world’s manufacturing superpower. It would have been nice if our media reported on that. But, alas, no.

Source: https://www.statista.com/chart/20858/top-10-countries-by-share-of-global-manufacturing-output/

China’s GDP

In 2000, China had the 6th largest economy. Today, it has the 2nd largest economy.

On a purchasing power parity (PPP) GDP basis, China now has the largest economy, surpassing the US.

Why purchasing power parity (PPP) GDP?

PPP GDP helps us see what people can actually buy in different countries. If two countries have the same amount of money but one has cheaper groceries, people there can get more for their money.

PPP GDP shows that living costs matter, helping us understand people’s daily lives beyond just big numbers. When we examine a country's GDP (its wealth), we should consider the cost of living to truly grasp how well people are doing. Many retirees realize this and move to countries with a lower cost of living for a better quality of life.

For that reason, economists often prefer PPP GDP over regular (nominal) GDP.

In any case, by any measure, today, China is an economic powerhouse.

GDP as of Q1 2024

Source: https://www.investopedia.com/insights/worlds-top-economies/

How can China’s manufacturing output be double that of the US, while the US has a higher GDP?

The key is in the composition of GDP: most of the US GDP comes from the tertiary sector (the service sector), which includes services like healthcare, education, finance, and retail. This reliance on services presents a national security concern for the US, as it highlights the country’s dependence on imports for goods produced in the primary (agriculture) and secondary (manufacturing) sectors.

With such a large portion of our GDP coming from the service sector, it can lull us into a false sense of complacency because a substantial part of what we need to live—ranging from food to products—is imported rather than made in the US.

China’s Economic Future

China is currently in a strong economic position. However, the US and EU have recently become concerned about their declining competitiveness. There is talk of tariffs and other measures that could complicate matters for China. On the other hand, China is now exporting more to the Global South, including BRICS (essentially non-NATO countries), compared to the US, EU, and Japan, thereby lessening its dependence on these markets.

China's Exports to the Global South vs. the US vs. the US + Europe + Japan

Source: https://asiatimes.com/2023/04/chinas-exports-shifting-from-west-to-global-south/

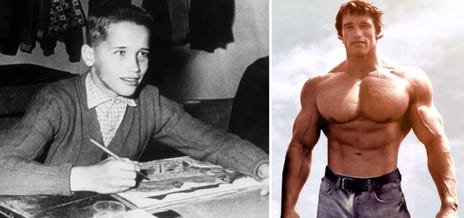

The comparison of Arnold Schwarzenegger’s physique comes to mind—his childhood (representing where China was a few decades ago) versus decades later (where China is today).

What Will the Future Bring for China?

Let’s start with where China is today compared to a few decades ago. Whenever I think of a good way to visualize this, I can’t help but think of Arnold Schwarzenegger. I picture how he looked as a kid versus how he looked in his prime. Arnold in his prime is a perfect way to illustrate where China is right now. I’m not saying China doesn’t have its problems—it definitely does! But I think this comparison really helps show China’s economic growth today.

But What About Going Forward?

One thing is always clear about the future: nothing is set in stone, and the future is what we make of it. This applies to individuals, companies, and countries.

“It’s difficult to make predictions, especially about the future.” – Yogi Berra (famous baseball player)

However, China is on track to make the 21st century a Chinese century, just as the 20th century was an American century. China, like other nations, will face its challenges. It has numerous challenges, including demographics, the real estate market, and so on.

But in the 20th century, the US faced multiple crises, such as the stock market crash in the 1920s, the Great Depression in the 1930s, stagflation in the 1970s, and so on—and yet the 20th century was undoubtedly the American century.

Similarly, China will face its challenges, but if I were a betting man, I would say that China’s chances of making the 21st century the Chinese century are way better than average.

Yet, this outcome is not guaranteed; it heavily depends on the policy decisions made by the US. For instance, will the US implement policies to incentivize the return of manufacturing back to the US? Just as China has achieved remarkable economic growth in the past 20 years through smart strategic policy choices, the US can also make substantial progress if it acknowledges the magnitude of the challenges it faces and takes the necessary actions to address them. Nothing is more American than a great turnaround story. Well, we shall see.

Major Chinese Companies

China has become a global leader in technological innovation, from e-commerce to artificial intelligence to renewable energies. While, for example, Tesla is seen globally as a leader in electric vehicle (EV) cars, the Chinese company BYD sold a greater number of EV cars than Tesla in the first half of 2023.

The Chinese company NIO has developed a unique battery swap technology (taking minutes) to solve the battery charging problem while on the road.

Many of these companies are traded either in Shanghai (SSE), Hong Kong (HK), Shenzhen (SZSE) or in the US (NYSE, NASDAQ, OTC). Here are some famous and very successful Chinese companies:

JD.com (JD.NASDAQ, 9618.HK)

JD.com, also known as Jingdong, is one of the largest online retailers in China, similar to how Amazon operates in the US as a retailer with an inventory. Founded in 1998, it has grown to become one of the largest online retailers in China, competing closely with Alibaba.

Stock Tickers: JD (US – NASDAQ, as American Depositary Receipts) & 9618 (China – Hong Kong)

US Equivalent: Amazon

2023 Revenue in US dollars: $152.8 billion

Global Fortune 500 Rank: 47th largest company in the world

Alibaba (BABA.NYSE, 9988.HK)

Alibaba Group, often referred to as the eBay of China, providing a marketplace without its own inventory, is one of the largest e-commerce companies in the world. Founded in 1999 by Jack Ma and a group of co-founders, Alibaba has grown tremendously and now competes closely with JD.com in the Chinese market.

Stock Tickers: BABA (US – NYSE, as American Depositary Receipts) & 9988 (China – Hong Kong)

US Equivalent: eBay

2023 Revenue in US dollars: $ 126.4 billion

Global Fortune 500 Rank: 70th largest company in the world

BYD (1211.HK, 002594.SZSE)

BYD, which stands for "Build Your Dreams," is a leading Chinese manufacturer of electric vehicles (EVs) and batteries, often referred to as the "Tesla of China." It is Tesla's largest competitor. In the first half of 2023, BYD was the top seller of electric cars, surpassing Tesla in terms of the number of vehicles sold. However, Tesla remained number one in revenue because its EVs are generally more expensive. By the end of 2023, Tesla caught up and sold more cars than BYD for the entire year.

Founded in 1995, BYD initially focused on battery production before expanding into the automotive sector in 2003. The company has quickly become one of the largest electric vehicle manufacturers in the world, known for its innovative technologies like the Blade Battery, which enhances safety and efficiency.

Stock Tickers: 1211 (China – Hong Kong) & 002594 (China – Shenzhen)

US Equivalent: Tesla

2023 Revenue in US dollars: $84.8 billion

Global Fortune 500 Rank: 143rd largest company in the world

Source: https://www.statista.com/chart/30758/most-popular-plug-in-electric-car-brands/

Baidu (BIDU.NASDAQ, 9888.HK)

Baidu is often referred to as the "Google of China," providing search engine services along with various internet-related products and services. Founded in 2000, Baidu has expanded its offerings to include artificial intelligence (AI) technologies and autonomous driving initiatives.

Stock Tickers: BIDU (US – NASDAQ, as American Depositary Receipts) & 9888 (China – Hong Kong)

US Equivalent: Google

2023 Revenue in US dollars: $18.9 billion

Global Fortune 500 Rank: Not included

What Every Investor Should Know About China

Political Risks

From a US investor's perspective, US sanctions used to be rare, limited, and targeted, essentially having little impact on American investors. However, that is no longer the case. As the US is falling behind economically, sanctions have become the go-to solution across different administrations to demonstrate that something is being done.

But are these sanctions effective in achieving their goals? No.

Do they complicate the investment landscape for U.S. investors? Yes, absolutely.

US sanctions now resemble lightning strikes—occurring more frequently and unpredictably. Even foreign stocks traded on US exchanges are not safe, whether they are Russian ADRs in 2022 or Chinese ADRs in 2020. When these sanctions are enacted, they can significantly affect stock prices.

For instance, in November 2020, President Trump signed an executive order that prohibited Americans from owning shares of China Mobile, which was listed on the New York Stock Exchange (NYSE) at the time. This led to a sharp decline in its stock price, and eventually, trading of China Mobile shares was suspended and removed from the NYSE. While investors could exchange their US-listed shares for Hong Kong-listed ones, this process wasn’t automatic. Some investors may have missed the chance to swap their shares simply because they were unaware of it or didn’t act quickly enough. In any case, US. investors were required to sell their shares, often at a loss.

Does that mean you should stay away from Chinese companies? No.

It just means that one should be aware of these potential challenges and pay close attention to the political mood in the US as an early warning sign of any potential sanctions. Additionally, consider not over-allocating your funds in the China sector or purchasing downside protection, such as puts. This (puts) is something that we will cover in more detail in next week’s article when we dive into Michael Burry’s latest portfolio changes (with heavy investments in China) and strategy.

Capital Controls

The easiest way for investors who want to buy Chinese stocks and avoid capital controls is to purchase them in the US (if available) or in Hong Kong. In Hong Kong, stocks are traded in Hong Kong dollars (HKD), which is pegged to the US dollar. Generally, there are no capital controls. This means money can move freely in and out of Hong Kong without restrictions.

If you are able to purchase directly from the Hong Kong Stock Exchange, from a US sanctions perspective, that may be the better approach. If there are ever US sanctions, you do not have the risk of non-conversion of your Chinese ADRs.

If you buy Chinese stocks in Shanghai or Shenzhen, they are traded in Renminbi (Yuan), which is subject to strict capital controls that limit how easily it can be exchanged into other currencies. Currently, individuals can convert (and transfer to the US) up to $50,000 worth of Renminbi per year unless they provide special documentation and approvals. To facilitate investing in Shanghai, there are additional mechanisms like QFII (Qualified Foreign Institutional Investor) and Stock Connect, but these go beyond the scope of this article.

Different Types of Shares in China

If you buy Chinese shares directly from a stock exchange in China, there are various types of Chinese shares. Understanding different share types—A-shares, B-shares, and H-shares—is essential for navigating investments in China.

A-shares are stocks of companies listed on the Shanghai and Shenzhen stock exchanges and traded in Renminbi. Historically, these were mainly available to Chinese investors, but foreign investors can now access them through programs like the Qualified Foreign Institutional Investor (QFII) program.

B-shares are also listed on these exchanges but are traded in foreign currencies and available to international investors; however, they have become less popular over time.

H-shares represent Chinese companies listed on the Hong Kong Stock Exchange and traded in Hong Kong dollars. These shares are often more accessible for foreign investors due to their established presence and regulatory framework.

Conversely, if you buy Chinese companies that are traded in the US, they are often American Depositary Receipts (ADRs), usually backed by H-shares, but not limited to H-shares.

Summary

China's rise as an economic powerhouse is nothing short of extraordinary. Back in 1990, its nominal GDP was just 7% of the U.S. economy, but by 2022, it had skyrocketed to around 73%. China's transformation offers incredible investment opportunities for those willing to explore them and manage the risks.

Are you missing out?

As legendary investor Jim Rogers has long recognized, China's potential is vast—and it may just be time for you to consider joining him on this journey into one of today's most dynamic markets!

In next week’s article, we’ll dive deeper into legendary investor Michael Burry’s China investment strategy.

Thank you for reading the article. Hope you enjoyed it.

Hungry for more? Subscribe to the newsletter - it's free and fabulous.Enjoyed this article? Don't keep it to yourself! Share it with a friend or two. It's free, and they might even buy you a coffee as a thank you.Your Fringe Finance

Disclaimer

Neither the author nor Fringe Finance is a financial advisor or a tax professional. This article is for illustrative and educational purposes only and does not constitute a specific offer of any product or service.

Past performance of stocks and assets is not an indicator or guarantee of future performance of stocks and assets.

The information in this blog does not constitute an offer to buy or sell, or a solicitation of an offer to buy or sell, any of the securities mentioned herein.

We believe the information provided is accurate and current. However, we do not guarantee its accuracy and it should not be considered a complete analysis of the topics discussed.

Any opinions expressed reflect the author's judgment at the time of publication and are subject to change.

Seek guidance from qualified financial and tax experts before taking action.

Great article, very bullish on China.

"China is now exporting more to the Global South, including BRICS (essentially non-NATO countries), compared to the US, EU, and Japan"

This is the most importance sentence. China's economic recovery depends on exporting more to the rest of the world. It's generally built strong relationships and goodwill with the Global South (Russia, Central Asia, Africa, ASEAN). China is mending fences with India to avoid the tumult of the past few years.

Unlike the West, Global South governments don't have as strong an incentive or the economic wherewithal to keep out high quality, affordable Chinese goods. Russia and Iran can't even trade with the West, so their only option is China.