Gold Miners: A Leveraged Bet on Gold

Unpacking the Leverage in Mining Stocks and What It Means for Investors

“Over the long run, the price of gold approximates the total amount of money in circulation divided by the size of the gold stock.”

— Ray Dalio

Gold miners can drive investors insane. On the one hand, if things run as they should, gold miners are a great way for a leveraged bet on gold. As shown below, a 33% increase in gold price should in theory increase a gold mining stock as high as 300% or even higher. But on the other hand, inept cost management and other one-time cost factors have often destroyed the leverage effect so desired by gold mining investors.

And one can see that. While gold went up from $2,000 to about $3,200, many gold miners didn’t do so well – mostly due to higher costs eating up the higher margin expected from a higher gold price. It is enough to drive a sane person insane.

But when it works, and it does work at times, owning a gold miner can be glorious. If, for extra leverage, one owns long-dated out-of-the-money call options, the returns can be downright astronomical. A $40,000 investment in call options could be worth over $1 million.

Let’s discuss all this: the leverage effect, how it should work in theory, what often goes wrong, how things can look when things go right, and different ways to play it, from buying the stock to buying long-dated out of the money (OTM) call options.

And the market conditions for miners seem juicy. As legendary gold and silver investor Rick Rule recently said:

“You have no excuse not to make a million or two in this market.”

More about that later.

Let’s take a look.

1. How Leverage Works, Explained Through US Gold Miner Newmont (NEM) – The Baseline

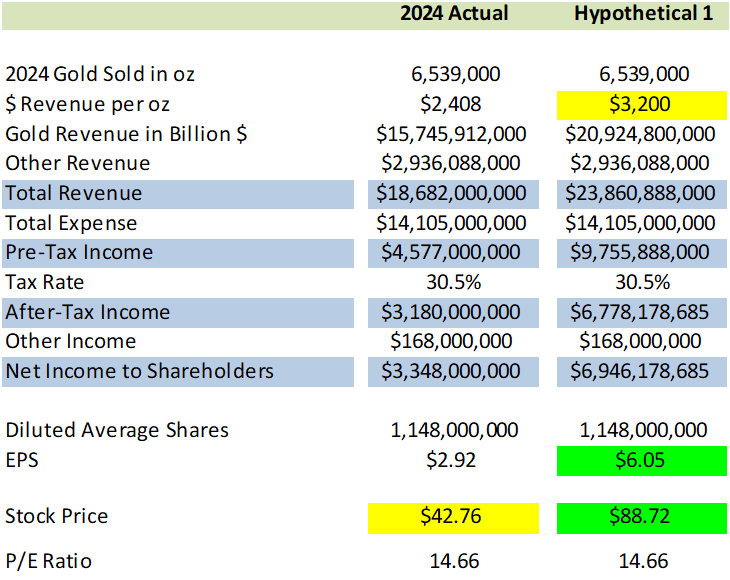

Let's look at the actual 2024 results for the US gold miner Newmont (NEM) to see how a gold miner's leverage is supposed to work in theory – and how it actually does when everything lines up. You can see a simplified profit and loss (P&L) statement for Newmont for 2024 below.

Newmont's total revenue was around $18.6 billion. Of that, $15.7 billion came from gold sales, with the average gold price being about $2,408 per ounce. If you go down the P&L, after expenses and taxes, there's about $3.3 billion left as net income for the shareholders. In 2024, there were roughly 1.1 billion shares out there, which means earnings per share (EPS) was about $2.92.

The average Newmont stock price in 2024 was $42.76. This works out to a price/earnings ratio (P/E) of around 14.7. This is our starting point before we dive into how leverage might hypothetically affect things, using these 2024 results as our example.

Newmont (NEM) 2024 Actual Financials

Sources: Yahoo Finance, 2024 Annual Report, Investing.com

2. The Gold Miner Advantage: Understanding Leverage with Newmont (NEM) at Gold Price of $3,200

In 2024, Newmont gold sales were calculated using an average price of around $2,408 per ounce. Right now, as I'm writing this, the average gold price per ounce is roughly $3,200, which is a lot higher. Let's explore how this higher gold price might affect the company's profit and loss (P&L), earnings per share, and stock price, assuming the company's stock is valued at the same P/E ratio of 14.7.

Newmont did have a number of unusual, one-time costs in 2024. However, to keep this example straightforward and conservative, I'm going to assume the same total expense (and assume the unusual cost will be incurred again). The tax rate is assumed to be the same. Let's dive in and see what happens with the higher gold price.

Newmont (NEM) 2024 Hypothetical Financials – Assuming Gold Price per oz of $3,200

Let's look at how a higher gold price for Newmont could impact things. If the gold price per ounce went up from its current $2,408 (in 2024) to a hypothetical $3,200, that would boost total revenue from about $18.6 billion to roughly $23.9 billion. If we then run that higher revenue through the company's finances, keeping the same tax rate of 30.5%, the net profit available to shareholders would jump to about $6.9 billion. That's a big leap from the actual 2024 profit of $3.3 billion.

This higher profit translates into significantly better earnings per share, around $6.05 compared to the actual $2.92 per share – a massive 107% increase. So, think about that: a 33% increase in the gold price led to a 107% increase in earnings per share, more than doubling the EPS. If we assume the company's stock continues to trade at the same price-to-earnings (P/E) ratio of about 14.7, that higher EPS suggests a hypothetical stock price of about $88.72 ($6.05 x 14.66).

So, in this scenario, let's see how a $100,000 investment would have played out in either gold itself or in Newmont:

Gold Investment (+33%, from $2,408 to $3,200): Your $100,000 investment would now be worth $133,000.

Newmont Investment (+107%, from $42.76 to $88.72): Your $100,000 investment would now be worth $207,000.

That is why many people love gold miners when gold goes up. But wait, it gets even better.

3. The Gold Miner Advantage: Understanding Leverage with Newmont (NEM) at Gold Price of $3,200 and a Higher P/E Ratio

Newmont's current P/E ratio is around 14.7, which is quite low compared to historical levels. For context, as of May 2024, the average P/E ratio for the S&P 500 is significantly higher at 28.37.

Source: https://www.multpl.com/s-p-500-pe-ratio

Given the leverage effect explained earlier, it's not unreasonable to think gold mining stocks could become more attractive to investors. If that happens, Newmont's P/E ratio could realistically move closer to the S&P 500 average of 28.37. Using the financials from section 2 (at a gold price of $3,200 per oz), but applying this higher P/E ratio of 28.37 instead of 14.7, the hypothetical stock price would be $171.66. This represents a significant 301% increase compared to the 2024 average stock price of $42.76.

Newmont (NEM) 2024 Hypothetical Financials – Assuming Gold Price per oz of $3,200 and a Higher P/E Ratio

So, in this scenario, let's see how a $100,000 investment would have played out in either gold itself or in Newmont. The previous Newmont scenario with only gold price increase is also shown for comparison.

Gold Investment (+33%, from $2,408 to $3,200): Your $100,000 investment would now be worth $133,000.

Newmont Investment (+107%, from $42.76 to $88.72): Your $100,000 investment would now be worth $207,000.

Newmont Investment, with also a higher P/E ratio of 28.37 (+301%, from $42.76 to $171.66): Your $100,000 investment would now be worth $401,000.

4. The Gold Miner Paradox: Why Investors Shun These Potential Winners

Given how a rise in gold prices can significantly boost profits for gold miners (the "leverage impact"), you might wonder why investors aren't always keen on them. The simple truth is often down to poor expense management. While it seems logical that higher gold prices should mean bigger profits, that's only true if the miners are good at controlling their costs. All too often, gold miners struggle with this, so that any gain from higher gold prices gets swallowed up by bigger expenses. This means their net profit margin doesn't really improve, and you don't see that expected boost in profits.

For investors, there are two main things to consider. First, is the gold miner in question actually getting better at managing its expenses, or at the least somewhat maintaining their cost levels, as gold prices rise? Second, are gold prices shooting up so fast and so high that the profit margin is still seeing a significant jump, even with poor expense management?

Think of it like this: say you earn $100,000 a year, and your costs (including taxes) are about $80,000, leaving you with $20,000 to save. If your salary went up by $10,000 to $110,000, but your expenses also climbed to $90,000, you wouldn't be able to save any extra, even with a higher income. This is often the frustrating situation with gold miners, leaving investors waiting for that profit boost feeling a bit crazy. Now, imagine your salary jumps from $100,000 to $150,000, while your expenses only go up from $80,000 to $90,000. Despite those higher expenses, your annual savings now soar from $20,000 ($100,000 minus $80,000) to $60,000 ($150,000 minus $90,000). This second scenario is what happens to gold miners when gold prices outrun their tendency to spend more.

Considering how quickly gold prices have climbed and are expected to continue rising, I believe we're currently in that second, more favorable scenario. While it's still important for investors to understand how well a gold miner manages its costs, given the strong increase in gold prices, excellent expense management might be a little less critical right now. It's still preferable, of course, but perhaps not as absolutely essential.

5. How to Invest in Gold Miners

The straightforward play is to purchase the stock and wait it out, monitoring the situation. For a bit of a more aggressive play, and assuming you understand options trading, buying a long-dated OTM (out of the money) call can be a great way to get an even better return. Of course, options trading has its own learning curve, and one needs to be familiar with its intricacies, as one can lose the total investment if done wrong.

Let’s walk through one example. The longest-dated call option for Newmont (NEM) has a maturity of January 15, 2027, about 1.5 years from now. As of May 3, 2025, the ask price for a January 15, 2027 call with a strike price of $85 is about $2.97 per share. Options trade in 100s, so the smallest position one can take would cost about $297 for a call option with a strike price of $85 for 100 shares.

Assuming everything goes perfectly and in one year (May 2026), Newmont's stock price reaches $171.66 (based on section 3's prediction of a $3,200 gold price and a 28.37 P/E ratio). If that happens, your initial $297 investment, looking only at the option’s intrinsic value (the difference between the stock price and the call price) and ignoring their time value, would be worth $8,666 ($171.66 minus $85, multiplied by 100 shares). This represents an increase of nearly 2,800%. Note that in reality, the time value of the option may make the option more valuable if enough time is remaining (worth more than $8,666).

So, in this scenario, let's see how a $100,000 investment would have played out in either gold itself or in Newmont. The previous two Newmont scenarios are also shown for comparison.

Gold Investment (+33%, from $2,408 to $3,200): Your $100,000 investment would now be worth $133,000.

Newmont Investment (+107%, from $42.76 to $88.72): Your $100,000 investment would now be worth $207,000.

Newmont Investment, with also a higher P/E ratio of 28.37 (+301%, from $42.76 to $171.66): Your $100,000 investment would now be worth $401,000.

Newmont Long Dated OTM Call Options (+2,800%, from $297 to $8,666): Your $100,000 investment would now be worth about $2.92 million.

Here is a quick breakdown of the profit calculation of the out of the money (OTM) call option scenario.

Let's illustrate the incredible potential of putting that $100,000 into a Newmont call option. Based on prices from May 3, 2025, your $100,000 investment allows you to buy a call option package that covers 33,670 Newmont shares (calculated by dividing your $100,000 by the option's price of $2.97 per share). Think of this option as giving you a special right, but not the obligation, to purchase these shares at a fixed price – called the "strike price" – of $85, anytime between now and January 15, 2027.

Now, imagine a scenario where Newmont's stock price skyrockets to $171.66 (see the hypothetical example from section 3 above) well before the option expires in 2027. Your option is suddenly worth a fortune! At a minimum, you could immediately sell this valuable option for its "intrinsic value." This is the difference between the current high stock price ($171.66) and your much lower strike price ($85), which is $86.66 per share. Since your option package covers 33,670 shares, selling it would bring in a truly staggering return of $2,917,842 ($86.66 multiplied by 33,670 shares)!

Alternatively, instead of selling the option, you could "exercise" it. This means you'd use your right to buy the 33,670 shares for just $85 each, costing you $2,861,950, even though they are currently trading at $171.66 (a market value of $5,779,792). You could then immediately sell these shares on the open market for a significant profit, or hold onto them.

You even have the flexibility to sell some of your options and exercise others. If you are using the profits from the sale of some of the options to fund the exercise of other (remaining) options (to purchase the shares), it is important to put aside your tax obligations due on the profit from the option sale.

However, it's crucial to understand the significant risk here. While the potential profits are enormous, this outcome is not guaranteed. If Newmont's stock price stays flat, drops, or doesn't get anywhere near $85 by the time the option gets close to expiring, your option could become worthless. In that scenario, you could lose a substantial amount, or even all of the $100,000 you invested in the call options. This high-reward potential comes with equally high risk.

Again, it's important to note here that being fully aware of the risk is key. As you shift from straightforward gold investments to mining stocks and then to options, the potential for higher returns increases, but the risk does too. Especially with options, if the price doesn't move as you expect before the option runs out, you could lose your entire investment. This is due to the option's time value decreasing over time, a process that usually speeds up in the final three months. Many options traders extend their position (roll over), but doing this outside a retirement account can trigger tax issues.

6. Summary

Legendary gold and silver investor Rick Rule recently said: “You have no excuse not to make a million or two in this market.” He recently shared 22 mining companies that he's invested in. You can read about it here. I used Newmont (NEM) as an example here, but that's not an endorsement of Newmont. For full disclosure, I own call options on Newmont, and I sold cash-covered puts on Newmont to help pay for some of those calls (a topic for another day).

Anyway, I hope this analysis shows why many investors, including me, like owning gold miners as part of their portfolio. As always, it's important to understand the potential for gains (upside) but also the risks involved, which is especially crucial for options trading.

Thank you for reading the article. Hope you enjoyed it.

Hungry for more? Subscribe to the newsletter - it's free and fabulous.Enjoyed this article? Don't keep it to yourself! Share it with a friend or two. They might even buy you a coffee as a thank you.Your Fringe Finance

Disclaimer

Neither the author nor Fringe Finance is a financial advisor or a tax professional. This article is for illustrative and educational purposes only and does not constitute a specific offer of any product or service.

Past performance of stocks and assets is not an indicator or guarantee of future performance of stocks and assets.

The information in this blog does not constitute an offer to buy or sell, or a solicitation of an offer to buy or sell, any of the securities mentioned herein.

We believe the information provided is accurate and current. However, we do not guarantee its accuracy and it should not be considered a complete analysis of the topics discussed.

Any opinions expressed reflect the author's judgment at the time of publication and are subject to change.

Seek guidance from qualified financial and tax experts before taking action.

Q1 data supports the analysis.

Q1 was $1.25/sh earnings at $2,944/oz realized. Yahoo has the TTM P/E at 12.44 and the Forward P/E at 8.74. Spot-checking the analyst reports, I think the consensus estimates are based on around $3,000/oz for the next twelve months.

So, let’s say the $3k line just holds, in line with estimates, and expenses are in line. (Re expenses, cheap oil creates some opportunities, though more expensive capex due to trade wars could certainly offset.) If the share price just catches up to keep the P/E constant, based on that Forward P/E, you’re looking at a ~$70+ share price. Catch back up to a 14.66 P/E and you are over $80.