How Legendary Investor Seth Klarman’s Investment in GDS Holdings Soared 389%

Legendary Investors Series: Learn from the best to shortcut your journey to financial freedom!

“The single greatest edge an investor can have is a long-term orientation.”

— Seth Klarman

Legendary investor Seth Klarman is an American billionaire and the founder of the Baupost Group, a highly successful hedge fund that focuses on value investing, based in Boston, Massachusetts. He’s known for his careful, risk-conscious approach, always looking for undervalued stocks that offer a “margin of safety.” With “margin of safety,” he means buying investments at a price significantly below their true value to reduce downside risk and protect yourself if things go wrong.

Klarman also wrote the famous book “Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor,” and many people compare him to Warren Buffett because of his patient, long-term, and often contrarian investing style.

Seth Klarman’s portfolio is fairly concentrated, currently holding 23 investments with a total value of around $3.5 billion. One of Klarman’s standout investments recently has been the Chinese IT company GDS Holdings, which has seen a remarkable gain of 389%, rising from about $6.65 in March 2024 to about $32.51 by July 2025. This impressive return highlights Klarman’s ability to identify undervalued opportunities with significant upside potential.

Seth Klarman, like many legendary investors, is someone worth following to sharpen your investment skills and discover opportunities you might not have otherwise considered. With roughly 5,000 public companies traded in the US and about 55,000 globally, it’s impossible for any one person to keep track of every potential investment opportunity.

As legendary investor Jim Rogers likes to say, "Play to your strengths with your investments." For example, if you're passionate and knowledgeable about AI, and a legendary investor invests in certain AI companies, that’s your edge. The same applies to other fields—find what legendary investors do that overlaps with your expertise or interests, and focus there to do your investment research (your homework) to see if that investment might fit into your portfolio. That is your edge. Good hunting!

In the following sections, you will discover:

Unpacking GDS Holdings: What made this Chinese IT company’s stock soar by 389%?

Klarman’s Exits and Reductions: Exits and reductions that reveal his strategy in action

Big Increases and New Bets: What Klarman increased and bought and why it matters

Most Significant Investments: Overview of Klarman’s most significant recent investments

Essential Investment Lessons: Actionable insights from Klarman’s approach to investing

Let’s take a look.

1. Unpacking GDS Holdings: What made this Chinese IT company’s stock soar by 389%?

Klarman started to acquire GDS in the quarter ending March 31, 2024 (Q1 2024). From then to now (July 2025), it is up 389%, rising from $6.65 in March 2024 to $32.51 by July 2025. So, what is GDS, and what explains this almost 4x increase?

The company was founded in 2001 and is headquartered in Shanghai, China. Shanghai is a perfect example to show how much China has changed. Here is a comparison of the Chinese city of Shanghai in 1987 versus today:

Impressive, isn’t it? The development is similar to other Chinese cities. The Fringe Finance Report wrote about this in December 2024 in the article called “China: Legends Are Investing - Are You?” You can read it here.

Coming back to Klarman’s GDS investment, GDS Holdings is one of the country’s top developers and operators of high-performance data centers. These data centers are critical infrastructure that houses servers and IT equipment for major internet companies, cloud providers, financial institutions, and telecom operators.

GDS’s facilities are strategically located in China’s primary economic hubs, including Shanghai and Beijing, where demand for data storage and cloud computing is booming. The company is neutral to operators, meaning it works with multiple cloud and telecom providers, giving its customers broad access to networks and public cloud platforms.

GDS went public on the Nasdaq in 2016.

Source: https://www.globenewswire.com/NewsRoom/AttachmentNg/35516ae9-038d-41e0-ad66-d2c184e66da0

In early 2024, Baupost Group acquired GDS. At the time, GDS was trading at depressed levels, weighed down by China's economic slowdown fears and GDS being unprofitable.

But Klarman saw what others missed: GDS was a critical infrastructure play in China’s AI and cloud computing boom. Unlike flashy tech startups, GDS provided the backbone—high-performance data centers serving hyperscalers like Alibaba, Tencent, and global cloud providers.

It goes back to the old investor adage, “If you want to impress strangers, buy the flashy business. But if you want to make money, buy the boring company that everyone needs.”

Source: https://stockanalysis.com/stocks/gds/

Is GDS still a good investment?

The Bull Case: With China’s cloud and AI markets still in the early innings, GDS could still see a lot of revenue growth in the years to come.

The Risks: Geopolitical tensions or regulatory crackdowns could disrupt growth, and GDS’s debt level is still on the high side.

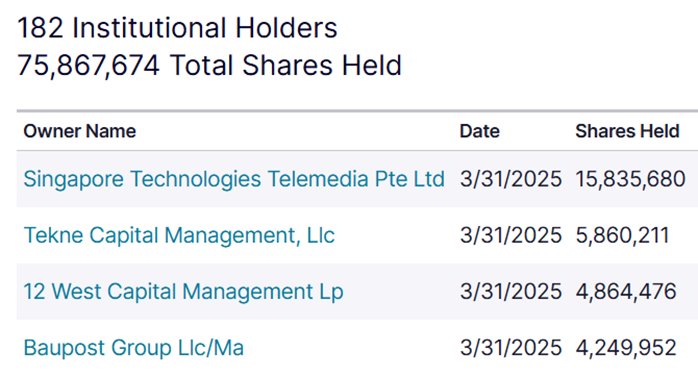

Klarman is certainly still bullish on GDS. As of March 31, 2025, Klarman was the 4th largest institutional owner of GDS, as reported by Nasdaq.

Source: https://www.nasdaq.com/market-activity/stocks/gds/institutional-holdings

Now that we've looked more closely at Klarman’s GDS acquisition and how it performed, let’s turn to his most recent portfolio changes, especially his reductions and exits. The main idea is that, if you own similar stocks, you might want to consider copying his moves.

2. Klarman’s Exits and Reductions: Exits and reductions that reveal his strategy in action

2.1 Exits

In Q1 2025, Seth Klarman's Baupost Group exited the following three key positions:

Sunrise Communications (SNRE)

Humana (HUM), and

Genuine Parts Company (GPC)

Seth Klarman's Baupost Group Portfolio & Changes – Exits Only

Source: Baupost Group 13F SEC Filing

1. Sunrise Communications (SNRE) – Why Sold?

SNRE is a Swiss telecom provider facing intense competition in Europe’s crowded telecom market. Regulatory pressures and high capital expenditures for 5G rollout may have reduced long-term profitability prospects. Klarman likely saw better opportunities elsewhere, as telecom stocks often struggle with low-margin growth.

2. Humana (HUM) - Why Sold?

Humana, a U.S. health insurer, has faced rising medical costs and regulatory scrutiny over Medicare Advantage pricing. Humana is currently at a 5-year low. Some investors invest in Humana, betting on a turnaround story. Klarman does not.

3. Genuine Parts Company (GPC) - Why Sold?

GPC, a US auto parts distributor, is sensitive to economic cycles—slowing consumer spending could hurt demand. Global supply chain disruptions and rising input costs may have squeezed margins.

2.2 Reductions

In terms of reductions, in Q1 2025, Seth Klarman’s Baupost Group reduced positions in the following six companies:

Willis Towers Watson (WTW)

Liberty Global Class C (LBTYK)

Liberty Global Class A (LBTYA)

Viasat (VSAT)

Solvay (SOLV)

Clivet (CLVT)

Each of these companies operates in distinct sectors, and Klarman’s reductions likely reflect a combination of portfolio rebalancing, risk management, and strategic shifts toward higher-conviction opportunities.

Seth Klarman's Baupost Group Portfolio & Changes – Reductions Only

Source: Baupost Group 13F SEC Filing

Willis Towers Watson (WTW / -16.9%) – Why Reduced?

Willis Towers Watson, domiciled in Ireland and headquartered in London, is a global firm that helps companies manage risks and design employee benefit programs. They provide consulting and insurance services to improve business performance and protect assets.

Even with the recent reduction, WTW remains Baupost’s number one investment, comprising 14.7% of his total portfolio.

However, a potential softness among their customer base in the financial and consulting sectors might have made Klarman cautious, which is probably why he trimmed his investment by 16.9%. Whenever there is a softness in the market, and companies need to cut costs, consulting spend is typically the first stop.

Liberty Global Class C (LBTYK / -37.5%) and Class A (LBTYA / -2.4%) – Why Reduced?

Liberty Global, headquartered in Bermuda, is a major European telecommunications company offering broadband internet, TV, and phone services. Both shares are different types of stock with slightly different voting rights but represent ownership in the same company.

LBTYK after his reduction is still the 4th largest investment in Klarman’s portfolio.

LBTYA after his reduction is now the 17th largest investment in his portfolio. It was already one of his smaller investments before he reduced it by 2.4%, and it is still small.

Heavy competition and big costs for upgrading networks like 5G may have made the telecom business less attractive.

Viasat (VSAT / -16.6%) – Why Reduced?

Viasat, headquartered in California, provides satellite-based internet and communication services worldwide. This is now his 13th largest investment. They serve homes, businesses, governments, and airlines, offering internet connectivity even in remote areas.

VSAT faces tough competition in satellite internet and technology risks, so Klarman likely trimmed his stake to balance his portfolio.

Solventum Corporation (SOLV / -27.2%) – Why Reduced?

Solventum Corporation, headquartered in Minnesota, is a healthcare company that makes medical supplies, dental products, healthcare software, and filtration systems. After the reduction, this is now his 14th largest investment.

SOLV is a newer healthcare company, and Klarman may be reducing exposure due to uncertainties with its growth.

Clarivate Analytics (CLVT / -70.3%) – Why Reduced?

Clarivate Analytics, headquartered in London, offers data, analytics, and tools that help researchers, universities, and companies protect intellectual property and accelerate innovation. After the reduction, this is now his 18th largest investment. Their products include scientific databases and patent research services.

The company’s consistent losses combined with valuation concerns might have led Klarman to a smaller position in this data and analytics firm.

These changes show that Seth Klarman is very careful with risk and looks for the best chances to invest. When he sells or reduces his stocks in companies that are facing strong competition, uncertain rules, or financial troubles, he is protecting his money. Then, he focuses on investments he believes will grow better over time. This careful way of investing helps Klarman’s fund adapt to changing markets.

Klarman’s behavior is a good lesson for all of us: always manage your risks and look for the best opportunities. Be patient, but don’t get stuck with your investments if the situation changes.

We discussed the exits and reductions. Now, let’s switch gears and focus on the new bets and big increases. Maybe there is an investment there that you might want to purchase too? Something with a lot of upside potential. Something like the +389% GDS investment we discussed above. Let’s take a look.