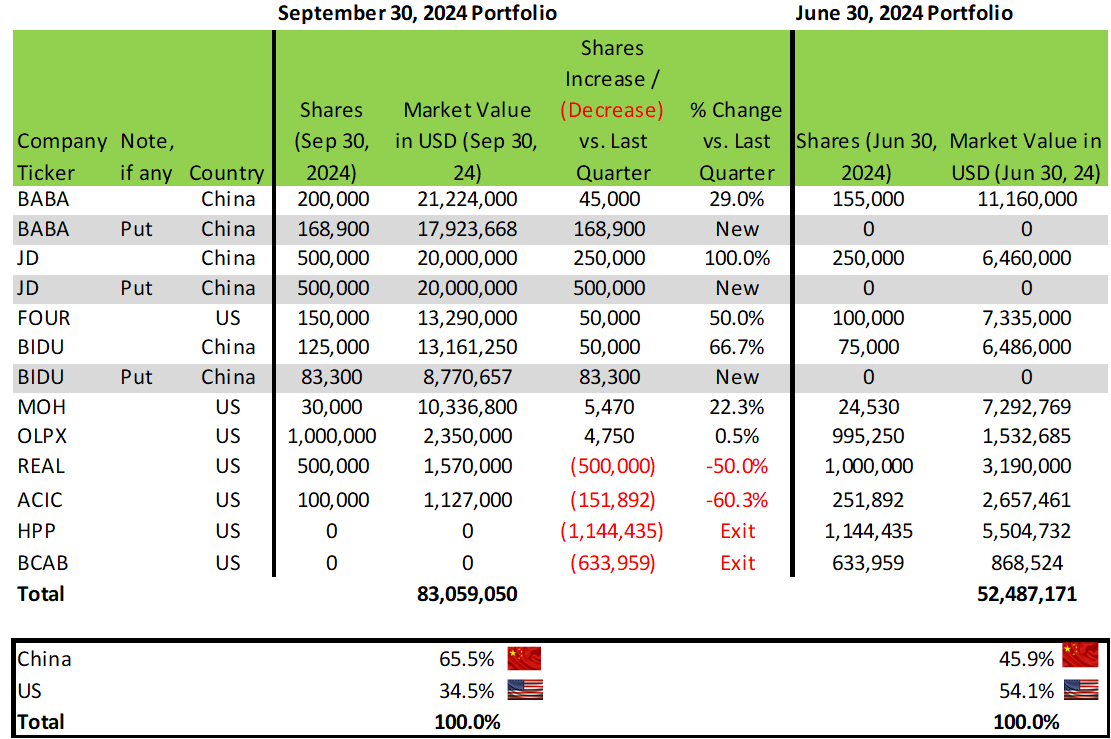

Michael Burry, the legendary investor who made a lot of money predicting the 2007 housing crash, has significantly increased his investments in China and reduced some investments in the US. This was reported in his latest SEC filing in November 2024 for his September 30, 2024 portfolio.

Major Portfolio Changes in a Nutshell

Michael Burry has increased his exposure to China. China now accounts for about 65% of his investments. At the same time, Michael Burry bought puts on his China investments. More on the why of this below.

At the same time, Michael Burry trimmed his US investments. He is down to 2 main US investments (FOUR and MOH). He also has 1 smaller US investment (OLPX) that remained essentially unchanged and 2 US investments (REAL and ACIC) that were reduced by about 50%. 2 US investments were completely sold off (HPP and BCAB).

Below, I will focus on the Chinese investments, the large US divestment (HPP), and the remaining 2 main large US investments (FOUR and MOH).

The November SEC filing shows Burry's portfolio as of September 30, 2024. The previous SEC filing shows Burry's portfolio as of June 30, 2024.

Michael Burry’s Portfolio – September 30, 2024 vs. June 30, 2024

Data source: https://www.sec.gov/Archives/edgar/data/1649339/000090514824003106/0000905148-24-003106-index.htm

Burry’s China Investments

Michael Burry has significantly increased his exposure to Chinese companies, but he is highly concentrated in just 3 Chinese companies:

Alibaba, the eBay of China - increased his stake by 29% from 155,000 shares to 200,000 shares.

JD, the Amazon of China - increased its shares by 100% from 250,000 shares to 500,000 shares.

Baidu, the Google of China - increased its shares by 66.7% from 75,000 shares to 125,000 shares.

Interestingly, he also bought put options on all 3 of his Chinese investments.

The question is: why?

Michael Burry didn't give a reason, but the speculation is that it has mostly to do with geopolitical risk. As geopolitical tensions rise, the US government has been sanctioning more and more companies, including Chinese companies. 5 years ago, the thought of the US government sanctioning major Chinese companies like JD, Alibaba and Baidu would have been laughable, but based on the actions of the US government over the last 5 years (both administrations), US-originated political risk (US sanctions) is now something that US investors need to consider.

At the same time, all 3 Chinese companies look very compelling and are trading at very attractive levels, and given China's continued bright future, are compelling investment opportunities. In a world without US political risk, IMO, all 3 companies are clear buys. China is now the 2nd largest economy in the world. It is also the largest manufacturer in the world – larger than the US and Europe combined. For more information on China, please read this post.

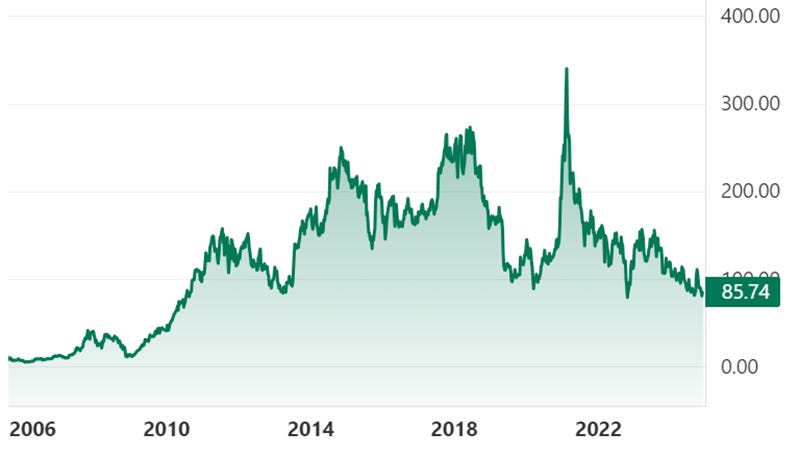

Alibaba (China’s eBay) - 70th largest company in the world (Global Fortune 500)

NYSE: BABA, US Dollar

Source: https://stockanalysis.com/stocks/baba/

Alibaba Group, often referred to as the eBay of China, providing a marketplace without its own inventory, is one of the largest e-commerce companies in the world. Founded in 1999 by Jack Ma and a group of co-founders, Alibaba has grown tremendously and now competes closely with JD.com in the Chinese market.

Stock Tickers: BABA (US – NYSE, as American Depositary Receipts) & 9988 (China – Hong Kong)

US Equivalent: eBay

P/E Ratio: 17.72

2023 Revenue in US dollars: $126.4 billion

Global Fortune 500 Rank: 70th largest company in the world

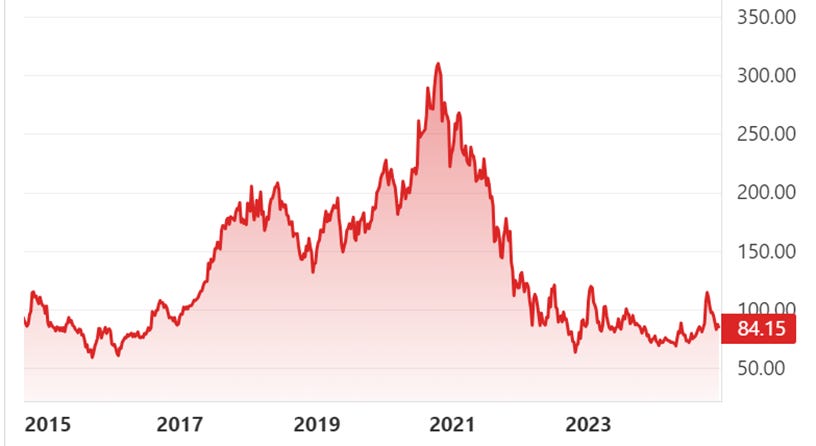

JD.com (China’s Amazon) - 47th largest company in the world (Global Fortune 500)

NASDAQ: JD, US Dollar

Source: https://stockanalysis.com/stocks/jd/

JD.com, also known as Jingdong, is one of the largest online retailers in China, similar to how Amazon operates in the US as a retailer with an inventory. Founded in 1998, it has grown to become one of the largest online retailers in China, competing closely with Alibaba.

Stock Tickers: JD (US – NASDAQ, as American Depositary Receipts) & 9618 (China – Hong Kong)

US Equivalent: Amazon

P/E Ratio: 11.99

2023 Revenue in US dollars: $152.8 billion

Global Fortune 500 Rank: 47th largest company in the world

Baidu (China’s Google)

NASDAQ: BIDU, US Dollar

Source: https://stockanalysis.com/stocks/bidu/

Baidu is often referred to as the "Google of China," providing search engine services along with various internet-related products and services. Founded in 2000, Baidu has expanded its offerings to include artificial intelligence (AI) technologies and autonomous driving initiatives.

Stock Tickers: BIDU (US – NASDAQ, as American Depositary Receipts) & 9888 (China – Hong Kong)

US Equivalent: Google

P/E Ratio: 11.42

2023 Revenue in US dollars: $18.9 billion

Global Fortune 500 Rank: Not included

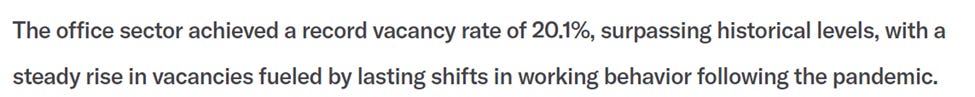

Major US Divestments

Michael Burry has sold 100% of his shares in HPP (Hudson Pacific Properties). HPP is a Real Estate Investment Trust (REIT) focused on office and studio space. With the continuing trend to work from home, the demand for office space has generally declined significantly. There may or may not be a few special cases where office space is still in demand, but in general, the demand for office space is cratering.

As Moody's put it on July 18, 2024:

Source: https://www.moodyscre.com/CRE-Leaderboard/12-month-vacancy-point-changes-office-sector/

If you still own an investment in office space, it might be a good idea to reassess whether you want to stay invested.

Major Continued US Investments

His two largest US investments are Shift4 Payments (FOUR) and Molina Healthcare (MOH), both non-cyclical US companies that would be relatively safe if the US stock market goes down. Shift4 Payments, Inc. is an American payment processing company, and Molina Healthcare, Inc. is a managed health care company based in the US.

Probably because the risk of a US stock market decline in the US is high. A fear that seems to be shared by legendary investor Warren Buffet, who has sold a lot of stocks and now has a record high cash balance.

Conclusion

Michael Burry is definitely a contrarian investor. And like everyone else, his track record is not 100%. But nobody's is. But he is undoubtedly a very smart, legendary investor.

The key take-away I take from his recent investment changes is that he continues to be bullish on China (specifically the 3 large Chinese companies) and now has 65% of his portfolio in China. At the same time, he seems to be concerned about US political risk (sanctions) and bought a bunch of puts to protect himself. Not a cheap strategy, but an effective one.

At the same time, his 100% divestment of his office REIT signals that he doesn't believe in a turnaround in US office space anytime soon. And his two largest continued US investments, Shift4 Payments (FOUR) and Molina Healthcare (MOH), would seem to signal that he currently prefers non-cyclical US companies, fearing a US stock market correction or recession.

Thank you for reading the article. Hope you enjoyed it.

Hungry for more? Subscribe to the newsletter - it's free and fabulous.Enjoyed this article? Don't keep it to yourself! Share it with a friend or two. It's free, and they might even buy you a coffee as a thank you.Your Fringe Finance

Disclaimer

Neither the author nor Fringe Finance is a financial advisor or a tax professional. This article is for illustrative and educational purposes only and does not constitute a specific offer of any product or service.

Past performance of stocks and assets is not an indicator or guarantee of future performance of stocks and assets.

The information in this blog does not constitute an offer to buy or sell, or a solicitation of an offer to buy or sell, any of the securities mentioned herein.

We believe the information provided is accurate and current. However, we do not guarantee its accuracy and it should not be considered a complete analysis of the topics discussed.

Any opinions expressed reflect the author's judgment at the time of publication and are subject to change.

Seek guidance from qualified financial and tax experts before taking action.

Burry moves in and out in days. Big question is - has he stayed in China. Greatest opportunity of the decade .. or Japan style deflation trap

Alibaba is also a cloud hosting company like Amazon’s AWS, so they are more diversified than it may first appear