Hecla Silver Mining Company – 30% vs. 100% vs. 2000%

One of Wall Street’s Top 3 Silver Mining Darlings

“You just can't beat the person who never gives up.”

— Babe Ruth

Not financial, investment, legal, or tax advice. Please read our full Disclaimer on the Disclaimer page. Accessible via the provided link and via the homepage menu. Continued reading constitutes your agreement to its terms.

Excellence exists in many disciplines. From legendary investors like Warren Buffett to world-famous baseball players like Babe Ruth. Babe Ruth is considered one of the most famous baseball players of all time. His legendary status extends beyond sports into American culture, making him a household name worldwide.

Babe Ruth played for the New York Yankees from 1920 to 1934, in addition to playing for other teams, and had a batting average of .342, meaning out of 1,000 balls, he hit 342. If you don’t know baseball, that doesn’t sound so great—hitting 1 in 3 balls—but that is beyond an excellent score. In any case, that put Babe Ruth among the best, if not the best of all time.

Why do I mention that?

It is because, in investing, an often-used expression is "no one hits a thousand," meaning even the most legendary investors don't always get it right. When investing, there are special kinds of personal hells. The most obvious is the hell of making the wrong investment and losing money. That happens to all of us—including Warren Buffett, as he freely admits. As they say in baseball and investing, no one bats a thousand (meaning no one gets a hit every single time at bat); in other words, no one is perfect.

But, in some ways, it is even worse (or at least it feels like it!) getting it right — like betting that silver will rise by 30% — and earning 30%, only to realize you could have made 100% or even 2,000% on that 30% silver price increase, if you had just used a different silver investment instrument. Let me explain.

Suppose you expect the price of silver to rise 30%. If you buy physical silver or an ETF backed by physical silver, and you’re right, you make 30%.

However, if you had bought shares of a silver mining company like Hecla during the same period, your gain could have been 100%.

And if you had purchased call options on a silver miner like Hecla within that timeframe, your gains might have soared as high as 2,000% or even higher.

These kinds of situations, where a better choice of investment vehicles would have increased one’s investment return, are enough to make anyone want to bang their head against the wall.

These numbers are just directionally correct and, of course, vary by mining company and options strategy employed. And, of course, each of these investment options comes with its own risk and reward profile — and I will cover that in more detail, including the math behind these sample results, in Section 7 below (Investment Strategies: Silver vs. Mining Company vs. Options — 30% vs. 100% vs. 2000%). I will also discuss whether Hecla, irrespective of past performance, is likely a good miner to buy going forward and whether it could be used for an option strategy.

With silver prices now close to $39, anyone who followed legendary investor Jim Rogers’ advice to buy silver in December 2024 would have had a 30% return. Back then silver prices were about $30. The Fringe Finance Report highlighted Jim Rogers’ advice in an article titled “Jim Rogers Buys Silver” published in December 2024.

Hecla Mining Company (HL) is a US company and a leading producer of silver and gold. Hecla (HL), next to Pan American Silver (PAAS) and Coeur Mining (CDE), is one of Wall Street’s silver mining darlings. We had a detailed analysis of PAAS last month in the article called “The Silver Rush Continues: Inside Pan American Silver (PAAS).”

Coming back to Hecla (HL), recently the stock price of Hecla has been on fire. In 3 days alone (from Aug 5, 2025, to August 8, 2025), it went from about $6.00 to about $7.60. A 26% increase in less than a few days, as many investors begin to see the great investment opportunity in miners.

In the following sections, I will cover the following about Hecla (HL):

1. Mine Properties: Assessing Location, Reserves & Production Efficiency

2. Leadership Matters: Assessing Executive Tenure & Company Culture

3. Financial Health Check: Liquidity, Profitability & Cash Flow Resilience

4. Risk Factors Uncovered: Operational, Financial & Governance Red Flags

5. Shareholder Friendliness: Dilution, Buybacks, Dividends & Insider Activity

6. Valuation Insights: Multiples, Metal Value & Market Sensitivity

7. Investment Strategies: Silver vs. Mining Company vs. Options — 30% vs. 100% vs. 2000%

8. Key Takeaways for Investors

For those new to mining, some sections start with a quick review of key concepts titled “Background Information – If you already know, please skip.” Feel free to skip if you’re familiar with the material.

For a much deeper dive—for people new to the mining space—please read the article “The Silver Rush Continues: Inside Pan American Silver (PAAS).”

1. Mine Properties: Assessing Location, Reserves & Production Efficiency

1.1 Background Information – If you already know, please skip.

This is the most critical aspect when you analyze a mining company. If the mines are not good, then the company is not good. Not having good mines is like going to a steakhouse and being told they don’t have meat. Understanding this aspect is the foundation for any mining company analysis.

To evaluate a mine’s quality, we need to know a few key things.

First, how much metal is underground—whether enough to fill just a small car or multiple supertankers—and how confident we are in those estimates. The industry groups mineral quantities into three categories based on confidence and economic feasibility:

Proven & Probable Reserves: These are the most reliable and economically mineable resources, forming the foundation of production plans.

Measured & Indicated Resources: Less certain than reserves but showing strong potential. With further study, about 40–70% may convert to reserves. Although these numbers can vary widely.

Inferred Resources: The least certain, based on limited data. Usually, only 10–20% eventually convert to reserves if confirmed. Although these numbers can vary widely.

Second, the cost to extract the metal depends on the ore grade (how much metal is in each ton of rock or dirt), with richer ore being cheaper to process. Metals in mines aren’t lumps of pure silver or gold; instead, they’re found in tiny concentrations that must be crushed and processed. For example, a gold mine with more than 5 grams per ton (about 0.18 ounces per ton) is considered high-grade.

Lastly, the mine’s location matters because different countries have varying rules and risks that can impact its value, such as outright confiscation of the mine or last-minute unexpected higher fees and taxes impacting the profitability of the mine.

1.2 How much metal does Hecla have in the ground?

Silver is typically produced as a byproduct of mining other metals such as lead, zinc, copper, and gold. As a result, many companies involved in silver mining generate only a fraction of their revenue from silver itself. An informal benchmark considers mining companies with at least 25% of their revenue derived from silver as silver miners. Pan American Silver typically fluctuates around that. That silver percentage is much higher for Hecla (HL).

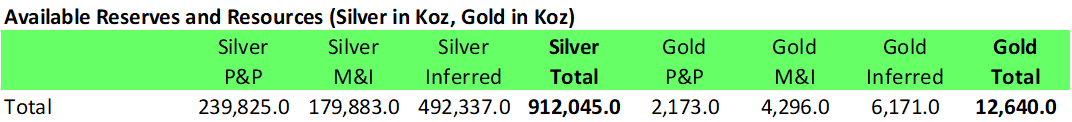

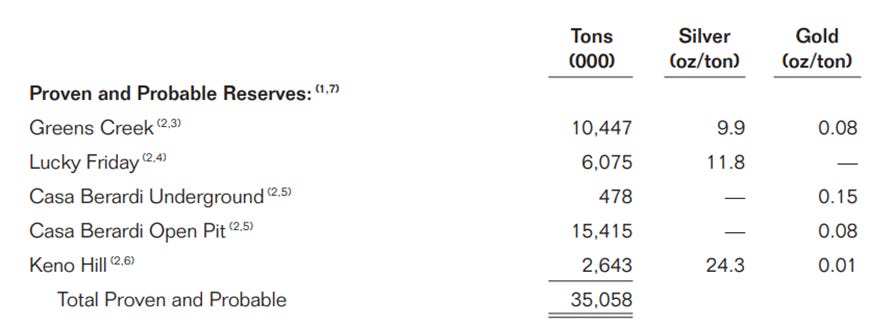

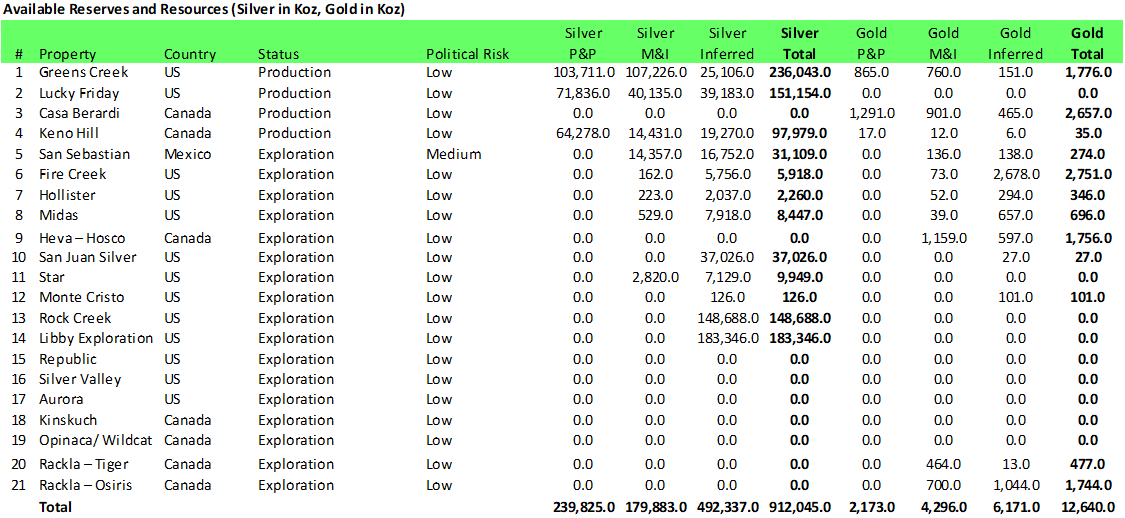

The following data is based on Hecla’s 2024 annual report. Please note that silver and gold are reported here in Koz (thousand ounces).

Source: Hecla (HL) 2024 Annual Report

P&P stands for Proven & Probable, and M&I stands for Measured & Indicated

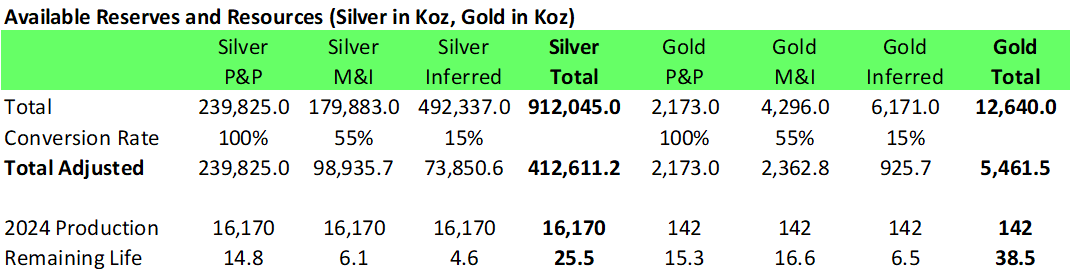

Based on 2024 production levels of 16,170 Koz of silver and 142 Koz of gold, and assuming the midpoint of the above-mentioned conversion figures (55% for Measured & Indicated, and 15% for Inferred), it means Hecla has enough silver and gold in the ground for a number of years.

Remaining Life of Hecla’s Silver and Gold

Silver: 25.5 years based on total silver and 14.8 years based on proven & probable only.

Gold: 38.5 years based on total gold and 15.3 years based on proven & probable only.

Below is a table that shows the calculations used for determining the above remaining life figures.

Source: Hecla (HL) 2024 Annual Report

Please note that this is a point-in-time snapshot – Hecla, like any miner, constantly explores and adds more mines.

1.3 What is the ore quality of Hecla’s silver?

Here, the question is “How much metal (silver or gold) is there per ton of dirt/rock?” The higher the ounces per ton, the more metal you can expect to extract from each ton of material, which generally makes the mine more profitable.

The following table shows the ore grade/quality of Hecla’s silver and gold in their proven and probable reserves.

Source: Hecla 2024 Annual Report

Based on industry standards, the amount of silver per ton (oz/ton) contained in Hecla’s mines is considered high grade, which is very good.

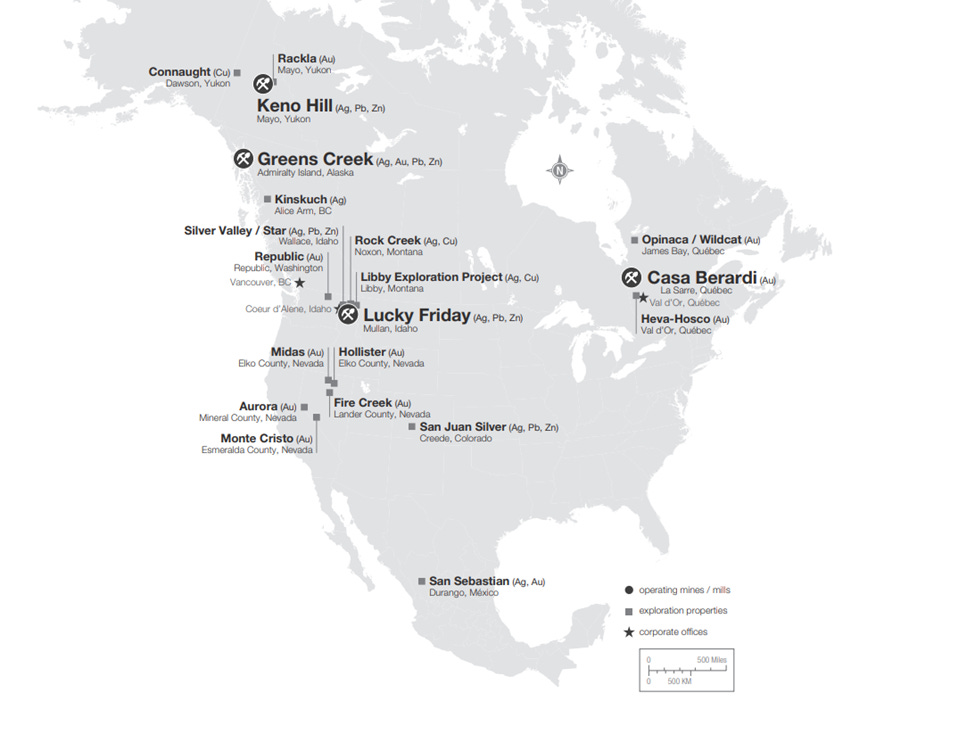

1.4 Where are Hecla’s mines located, and what are the country risks?

Hecla has operating mines in the US, Canada, and Mexico. Here is a map of its mine locations.

Source: Hecla 2024 Annual Report

Let’s group the mines by government-related risk levels—based on political, regulatory, and social factors:

Low Risk

United States: Stable political/legal environment, strong protections, predictable regulations.

Canada: Stable political/legal environment, strong protections, predictable regulations.

Medium Risk

Mexico: Mature mining jurisdiction, predictable taxes, but social conflicts can disrupt operations.

High Risk

None

The below table lists all of Hecla’s 21 mines based on Hecla’s 2024 Annual Report. P&P stands for Proven & Probable. M&I stands for Measured & Indicated.

Source: Hecla 2024 Annual Report

1.5 M&A (Merger & Acquisition)

As of mid-2025, Hecla Mining Company is not currently acquiring any other company but is rather selling or spinning off some of its exploration properties. Hecla's current focus is on optimizing its existing portfolio, advancing flagship projects (like Keno Hill), strengthening the balance sheet by reducing debt, and generating strong free cash flow.

In May 2025, Hecla signed a definitive agreement to transfer its Kinskuch property in British Columbia to Dolly Varden Silver in exchange for $5 million in shares. This is property 18 in the list in section 1.4 above.

In August 2025, Hecla sold the Toboggan project to Idaho Strategic Resources for $300,000 cash, while retaining a 1% net smelter royalty on parts of the property.

Source: https://www.mining.com/idaho-strategic-rises-on-gold-property-acquisition-from-hecla/

1.6 Mining Summary & Next Steps

Based on current reserve projections, Hecla has approximately 25.5 years of silver (14.8 years based on proven and probable reserves) and 38.5 years of gold (15.3 years based on proven and probable reserves). The vast majority (97%) of the mines are located in regions with low political risk (US & Canada). All in all, from a pure resource perspective, this is a great foundation for a silver mining company.

This analysis has shown that Hecla (HL) has enough silver in locations with low political risk to be able to produce silver for years to come. But as we know, potential only becomes performance if the execution is good.

The best ingredients don’t guarantee a nice and tasty dish if you can’t cook.

Cooking can be complicated, as the hapless Swedish cook from the classic goofball comedy "The Muppet Show" repeatedly demonstrates in his own funny way.

Now—can Hecla cook? Meaning, is their leadership up to the task? Are their finances strong and cost controls tight, so that higher silver prices actually lead to higher profits? Too many miners have let rising metal prices slip through their fingers by letting costs balloon—one of the main reasons why some investors hesitate with the mining sector. Are there red flags? Are they shareholder-friendly—i.e., focused on growing the stock price? And what about those different investment approaches, with 30%, 100%, or even 2,000% gains—what’s possible here?

These are the questions that separate a real opportunity from a costly lesson. In the next sections, let’s dig into the facts—and see if Hecla can actually turn all that underground silver into the kind of returns investors are hoping for.

Let’s dive in.