"If you don’t change direction, you may end up where you are heading."

— Lao Tzu

Typically, when legendary investors adjust their portfolios from quarter to quarter, they tend to make targeted and limited changes. While that is typically true, that was certainly not true for legendary investor Andreas Halvorsen and his firm Viking Global Investors for the last reported quarter.

Before we talk about it, let’s spend a minute on legendary investor Andreas Halvorsen. If he wasn’t real, you would think it was a movie script. He was born in Norway and started his career not in finance but as a naval commando in the Norwegian Special Forces. After that, he pursued his education in the US, ending with earning his MBA at Stanford. After some time working at Morgan Stanley, he started his fund, “Viking Global Investors,” in 1999, based in Greenwich, Connecticut, US.

And how did he do? As of the latest reported quarter (December 31, 2024), the total market value of his fund is about $31 billion. Not too shabby. That is why he is a legendary investor and a good source of inspiration for other investors trying to copy some of his investment choices.

As mentioned above, Viking did a major restructuring. It exited 19 companies, reduced investments in 26 companies, increased investments in 29 companies, and added 22 new investments.

Now this is change!

I will be discussing all of this in the following six sections. In section 6, “Key Investment Insights,” I will cover the key investment insights based on Viking’s Q4 2024 portfolio decisions.

Viking Global’s Total Portfolio – A Busy Quarter

Viking’s Big Financial Sector Bet

Viking’s IT Reshuffle

Notable Exits

Notable New Acquisitions

Key Investment Insights

Let's take a closer look.

1. Viking Global’s Total Portfolio – A Busy Quarter

As of his most recent SEC filing in February 2025 for the period ending on December 31, 2024, Viking Global owns shares in 86 companies. As I mentioned above, this was a wild quarter for Viking Global. Viking made 22 new investments, increased its investments in 29 companies, reduced its investments in 26 companies, and exited 19 companies. It is a diversified portfolio, except for one company (JP Morgan Chase with 5.8%); no company exceeds 4% of the total portfolio.

For the sector assignments (financial sector, etc.), I am using the sector assignment as provided by Viking Global in its SEC submission. As mentioned above, Viking Global had a number of changes last quarter ending in December 2024. In specific:

New investments: 22 companies

Increased investments: 29 companies

No change: 9 companies

Reduced investments: 26 companies

Exits: 19 companies

I will analyze the portfolio changes by theme (financial sector, IT sector, notable exits, and notable new acquisitions) to make the many portfolio changes easier to digest.

Total Portfolio of Viking Global Investors

Source: Viking Global SEC Form 13F

For the sector assignments, I am using the sector assignments provided by Viking in its SEC filing. That can differ from other perspectives, such as Yahoo Finance. Take the company Oscar Health (OSCR), for example, in which Viking is invested. Viking, in its SEC filing, classified it as a financial sector company. Yahoo Finance, by comparison, classifies OSCR as a healthcare company.

How can that be?

Viking’s perspective seems to be that while OSCR operates in the healthcare sector, it is really only active on the finance side of it. OSCR provides health plans and a platform for providers, payers, and reinsurance products. Really, it is more finance than healthcare, and Viking clearly sees its investment in OSCR as a financial sector investment.

One can quibble about what the right sector assignment is, but to be practical, this write-up is there to understand Viking’s decision, and how Viking looks at companies is part of it. Having said that, let’s get started.

2. Viking’s Big Financial Sector Bet

Viking's top five investments, which account for 20.2% of the total portfolio, are all concentrated in the financial sector. Once you add the other financial sector investments, the total investments that Viking has in the financial sector amount to 28.4%.

This heavy focus on the financial sector is a somewhat contrarian approach and indicates that Viking likely has confidence in the US economy's outlook and expects a decline in interest rates. After all, financial institutions usually do well when the economy is strong and interest rates are low. This is because banks can make more money from loans and other financial services when interest rates are low, as it costs less for people and businesses to borrow money. This often leads to more borrowing without a rise in defaults (as the economy is doing well), which is good for a bank’s bottom line.

Vikings Top 5 Holdings

JPMORGAN CHASE (JPM): 102.0% increase

US BANCORP (USB): 27.3% decrease

VISA INC (V): 0.3% decrease

BANK OF AMERICA (BAC): 23.8% increase

CHARLES SCHWAB CORP (SCHW): 526.5% increase

Legendary investor Warren Buffett seems equally optimistic about the financial sector. His numbers 2 and 3 investments are American Express and Bank of America (as of December 2024).

Viking’s Portfolio – Financial Sector Only

Source: Viking Global SEC Form 13F

If one looks at the financial sector part of the Viking portfolio above, one can see a preference for larger, diversified financial institutions over smaller players and insurance-focused firms.

The other thing to note here is that Viking is invested in two of the top five alternative asset managers: Apollo and KKR. Viking reduced its investment in KKR and started a new position in Apollo. Alternative asset managers typically make private investments worldwide in non-public companies. While these investments tend to be a bit more illiquid, they can be highly profitable.

Largest Alternative Asset Managers by AUM in 2025

Source: https://investingintheweb.com/blog/largest-alternative-asset-managers/

Viking isn’t the first legendary investor investing in alternative asset managers. Earlier last year, legendary investor Bill Ackman heavily invested in Brookfield, the 2nd largest alternative asset manager, making it his 2nd largest portfolio position. Click here to read more about it.

In Viking’s case, both alternative investments together only make up 0.7% of Viking’s total portfolio, but it is interesting to note nonetheless.

3. Viking’s IT Reshuffle

The IT sector within Viking’s portfolio saw a major reshuffle. At the end of the prior quarter (September 30, 2024), Viking’s top 2 and 3 investments were both IT (information technology). Adobe (ADBE) was Viking's number 2 investment with 4.95% of the total portfolio, and Apple (AAPL) was Viking’s number 3 investment with 4.13% of the total portfolio.

Viking exited Apple entirely. That is a major change, and it mirrors somewhat the move by legendary investor Warren Buffett, who had reduced his Apple investments by 2/3 since December 2023. Click here to read more about it.

In addition, Viking reduced its Adobe investment by 52.9%. That is another major change.

Viking’s Portfolio – IT Sector Only

Source: Viking Global SEC Form 13F

On the other hand, Viking made some notable additions:

Microsoft (MSFT): 16.9% increase, making it Viking’s 7th largest investment.

Intuit (INTU): 492.9% increase, making it Viking’s 6th largest investment. Intuit is famous in the US for its tax product TurboTax that many Americans use to file their taxes.

TSMC - Taiwan Semiconductor Manufacturing Company (TSM): A new position. Viking’s 11th largest position. TSMC is headquartered in Taiwan, the largest company in Taiwan, and the world's largest dedicated independent semiconductor foundry (chip maker). Think of TSMC as a chip maker (they build chips for others), Nvidia as a top chip designer (they focus on creating chip ideas), and Intel or Samsung as a combination of both (also called integrated device manufacturers or IDM). If computer chips were pizzas, Nvidia would come up with the recipe, Intel or Samsung would make their own pizzas in their own kitchens based on their own recipes, and TSMC would be the best pizza chef in the world, making pizzas for everyone based on other people’s recipes!

The top 2 major customers of TSMC are Apple with 25% of sales and Nvidia with 11% of sales.

TSMC recently (March 2025) announced a $100 billion investment in its US manufacturing capabilities. That is probably driven by tariff concerns and diversification concerns, should China annex Taiwan. Taiwan, where TSMC is headquartered, is in a tricky spot politically. China claims Taiwan as part of its territory, and tensions between the US and China are high. By building factories in the US, TSMC can protect itself from potential disruptions (like a conflict or trade wars) and show the US government that it’s a reliable partner.

4. Notable Exits

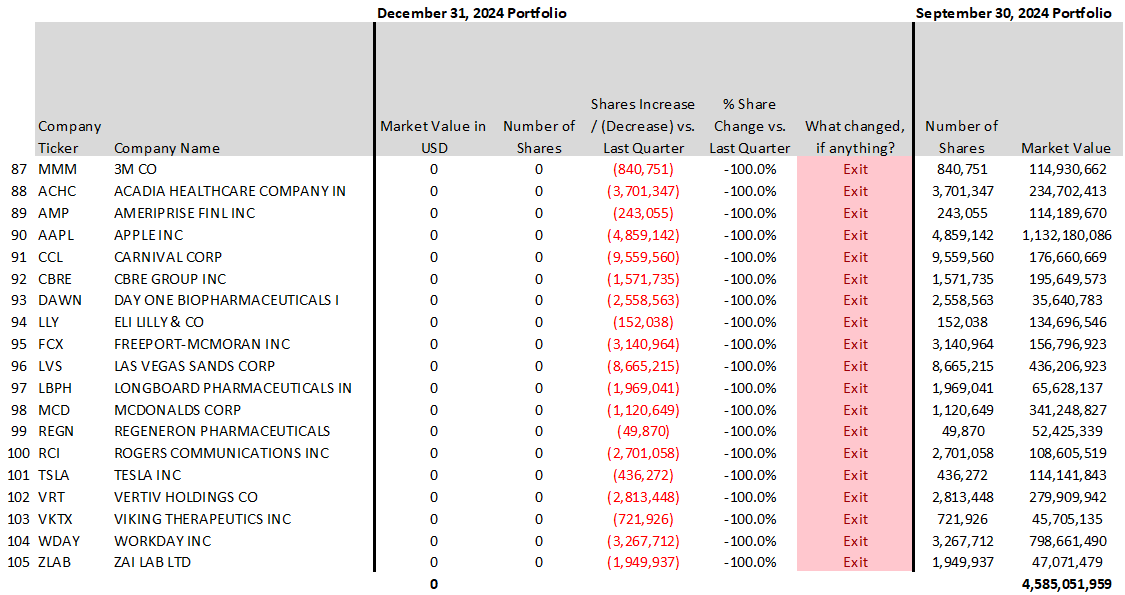

Viking completely exited 19 positions. Among the 19 positions, the most notable exits are Apple (as mentioned above), Tesla (TSLA), Eli Lilly (LLY), and McDonald's (MCD).

As for Tesla, its stock price almost doubled after the presidential election from November 2024 to December 2024, but has since lost its post-election gain. So the fact that Viking exited Tesla in Q4 was a good profit-taking move.

Companies that Viking Exited in Q4 2024

Source: Viking Global SEC Form 13F

5. Notable New Acquisitions

Viking invested in 22 new companies. Among the 22 new companies, the most notable entries are Taiwan Semiconductor Manufacturing (as mentioned above), United Health (UNH), Boeing (BA), Monster Beverage (MNST), and Intercontinental Exchange (ICE).

9th largest investment – United Health (UNH): While rising healthcare expenses on an individual consumer level continue to be a real problem, they also mean constantly growing revenue for United Health – the largest health insurance company in the US and the 8th largest global company (8th largest company – Global Fortune 500).

11th largest investment – Taiwan Semiconductor (TSM): As explained above (see section “Viking’s IT Reshuffle”).

22nd largest investment – Boeing (BA): Great turnaround potential if BA can ever get its act together again. There was a time when the aircraft manufacturer Boeing was the pride of America and the envy of the world. After a number of recent disasters (including crashes) and mishaps, the company stock price crashed from over $400 in 2019 to about $159 in 2025. If BA is able to return to its former glory, the stock price should skyrocket. But “if” is the operative word here.

29th largest investment – Monster Beverage (MNST): Monster Beverage is the 2nd largest energy drink company in the US after Red Bull. The underlying belief, I think, has to be that Viking believes that Monster can maintain its strong brand and fend off competition from rivals like Red Bull and new entrants, and that the company can innovate with new products (like healthier energy drinks) to stay relevant to changing consumer preferences.

30th largest investment – Intercontinental Exchange (ICE): ICE owns the world-famous New York Stock Exchange (the largest stock exchange in the world). The underlying belief, I think, has to be that Viking believes that financial markets and trading activity will continue to grow.

New Companies that Viking Added in Q4 2024

Source: Viking Global SEC Form 13F

6. Key Investment Insights

Here are the key takeaways from Viking’s investment decisions:

Overall

Viking Global’s portfolio reshuffle reflects a shift towards the financial sector and away from certain tech giants like Apple.

The firm’s investments in alternative asset managers and semiconductor manufacturing highlight a focus on diversification and geopolitical considerations.

Potential Sales

Apple: Viking sold its entire Apple position. Warren Buffett sold 2/3 of its Apple holdings. To me, Apple is a good company, but if legendary investors are running for the exit, maybe it is time to hit the pause button for now, get out of Apple, and buy it later on if the situation improves.

Potential Buys

Alternative asset managers like Blackstone, Brookfield, Hamilton Lane, Apollo, or KKR. This gives one exposure to non-public companies around the world. Legendary investor Bill Ackman invested heavily in Brookfield. Viking invested some in Apollo and KKR.

Taiwan Semiconductor Manufacturing Company (TSM). This world leader and critical computer/AI chip manufacturer is investing heavily in the US, away from the fragile location in Taiwan, and has the potential to become ever more important in the US computer supply chain.

Market leaders in health care (UnitedHealth – UNH) and stock trading (Intercontinental Exchange – ICE). Both are companies with a strong economic moat.

Thank you for reading the article. Hope you enjoyed it.

Hungry for more? Subscribe to the newsletter - it's free and fabulous.Enjoyed this article? Don't keep it to yourself! Share it with a friend or two. They might even buy you a coffee as a thank you.Your Fringe Finance

Disclaimer

Neither the author nor Fringe Finance is a financial advisor or a tax professional. This article is for illustrative and educational purposes only and does not constitute a specific offer of any product or service.

Past performance of stocks and assets is not an indicator or guarantee of future performance of stocks and assets.

The information in this blog does not constitute an offer to buy or sell, or a solicitation of an offer to buy or sell, any of the securities mentioned herein.

We believe the information provided is accurate and current. However, we do not guarantee its accuracy and it should not be considered a complete analysis of the topics discussed.

Any opinions expressed reflect the author's judgment at the time of publication and are subject to change.

Seek guidance from qualified financial and tax experts before taking action.