Warren Buffett Sells Banks, Keeps Apple, and Adds Cash & 6 Companies

Legendary Investor Series

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”

— Warren Buffett

Warren Buffett, nicknamed the "Oracle of Omaha," is a legendary investor who requires no introduction. His nickname is a combination of his exceptional investment acumen and the head office location of his company, Berkshire Hathaway, in Omaha, Nebraska.

Every quarter, investors around the world eagerly await Warren Buffett's latest quarterly portfolio (13F), which details the holdings of Berkshire Hathaway. His most recent quarterly report, as of December 31, 2024, was filed in February 2025 with the Securities and Exchange Commission (SEC).

This was another active quarter for Warren Buffett ending in December 2024, where he further increased his already massive portfolio and restructured his portfolio by buying shares of six companies (new & increases) and selling shares of twelve companies (exits & decreases). His new investment is in a US company that distributes the world-famous Mexican beer Corona in the US. More on that and the potential reasons below.

In this article, I will cover:

Warren Buffett Did Not Sell Apple This Quarter – The Dog That Didn’t Bark

Warren Buffett's Cash Position is Massive

Warren Buffett Sells Banks

Warren Buffett Adds 6 Companies

Buffett’s Total Portfolio & Changes

Summary

So, let’s take a look.

1. Warren Buffett Did Not Sell Apple This Quarter – The Dog That Didn’t Bark

Typically, Warren Buffet not reducing or increasing his position would not be news. However, Apple is different. For the last number of quarters, Warren Buffet has been reducing his Apple holdings significantly – quarter after quarter. But not in the last quarter ending December 31, 2024.

If you are familiar with Sherlock Holmes detective stories, then you are familiar with the expression “the dog that didn’t bark,” meaning don’t only look for things that happened, but also for things that you expected to happen but didn’t happen.

In the context of Warren Buffett’s investment in Apple (his continued number one investment), the “dog that didn’t bark” is that his Apple shareholding remained unchanged at 300 million shares as of December 31, 2024. As of September 30, 2024, he had the same number of shares.

This is significant as, in the prior quarters, he kept selling Apple shares, as one can see in the graph below.

From December 2023 to September 2024, he sold 2/3 of his Apple holdings – reducing his holding from about 900 million Apple shares to 300 million Apple shares.

But there was no further reduction in the last quarter (ending December 31, 2024).

I am not sure what this unexpected halt in selling Apple means. Apple is a great company – no doubt. At the same time, Apple’s P/E ratio of 37 is not low, and given the overvaluation concerns of the US tech market, it certainly made sense for Buffett to reduce his Apple holdings from 900 million shares to 300 million shares.

In my view, Buffett has reduced by 2/3 since December 2023 to de-risk his portfolio, and maybe that is enough risk adjustment for Buffett. We shall see. Something to monitor.

Number of Apple (AAPL) shares owned by Berkshire Hathaway

Source: Berkshire Hathaway SEC Form 13F

2. Warren Buffett’s Cash Position is Massive

Warren Buffett has increased his cash position (cash & US treasuries) from $167 billion in December 2023 to $334 billion in December 2024 (the last reported quarter). That is a massive increase – although the speed of the cash balance build-up has slowed down. In the last quarter (ending December 2024), he only added about $10 billion. Nothing to sneeze at, but significantly less than in the prior quarters since December 2023.

Berkshire Hathaway – Cash Position in $ Billion

Source: Berkshire Hathaway SEC Form 13F

Buffett is famous for his quote, “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.” The cash balance of $334 billion is Buffett’s bucket, I believe, for the next stock correction that Buffett sees coming.

Let’s look at his total portfolio – cash plus total investments – for a complete picture.

As Buffett’s cash balance increased, his invested portfolio was reduced – from about $353 billion in December 2023 to about $267 billion in December 2024; in other words, his cash position is now larger than his invested portfolio.

In December 2023, 67.9% of his portfolio was invested and 32.1% was in cash.

In December 2024, 44.4% of his portfolio was invested and 55.6% was in cash.

Berkshire Hathaway – Invested Portfolio vs. Cash Position

Source: Berkshire Hathaway SEC Form 13F

Warren Buffett did not give a public reason for his decision to move to cash, but as explained in more detail in my prior article “Warren Buffett Goes Cash and Adds Oil” covering Buffett’s investments as of September 2024 (click here), I think that he believes the US stock market is overvalued. Summarized so perfectly in his quote: “Be fearful when others are greedy, and be greedy when others are fearful."

3. Warren Buffett Sells Banks

Warren Buffett has 10 investments in the financial sector. Of those, he reduced, in some cases significantly reduced, his holdings in 4 banks/consumer finance companies.

In specific:

Citigroup (C): 73.5% reduction.

Nu Holdings (NU): 53.5% reduction. NU is a very successful digital banking platform primarily operating in Latin America.

Capital One Financial (COF): 18.1% reduction.

Bank of America (BAC): 14.7% reduction.

These are significant reductions. Typically, investors exit the financial services sector in response to macroeconomic factors such as economic downturns. If that is what Buffett believes, it would be in line with his record-high cash balance ($334 billion).

Changes in Warren Buffett’s Portfolio in the Financial Sector vs. Previous Quarter

Source: Berkshire Hathaway SEC Form 13F

What is interesting to note, though, is that Buffett keeps his remaining 6 financial sector investments constant. Specifically, he did not change the size of his investment in American Express (AXP), Moody’s (MCO), Chubb (CB), Aon (AON), Ally Financial (ALLY), and Jefferies Financial (JEF).

If you believe, as Buffett seems to believe, that we are on track for economic difficulties, he must have a reason why he kept these companies. My take is the following:

Caters to a higher income demographic that is more isolated from economic trends: American Express

Huge economic moat as a global rating agency: Moody’s

Insurance companies tend to be isolated from economic trends: Chubb and Aon

Unknown reasons: The investment bank Jefferies and Ally Financial

4. Warren Buffett Adds 6 Companies

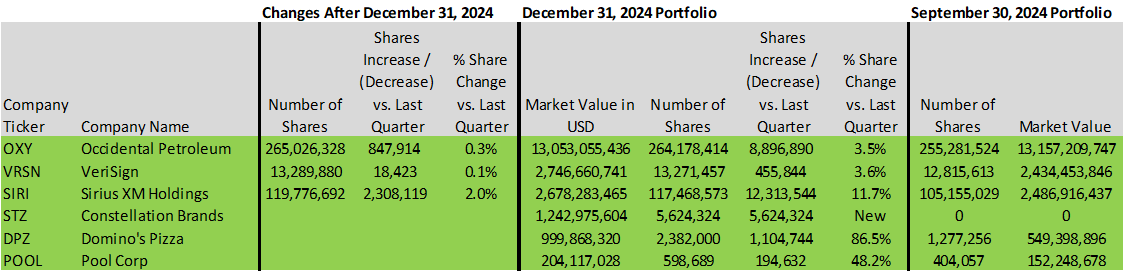

It is reasonable to assume, based on Warren Buffett’s actions (record cash balance, etc.), that Warren Buffett’s outlook on the US stock market is less than favorable. Given this assumption about the perspective of Warren Buffett, any increase in his position of US stocks and any new position in US stocks is noteworthy. He increased his position in 5 companies (DPZ, OXY, VRSN, SIRI, POOL) and added one new company (STZ). Specifically:

Increases

Domino's Pizza (DPZ): Increased his investment in this pizza chain by a whopping 86.5% vs. the last quarter (September 2024). Domino’s Pizza is now Buffett’s 22nd largest investment.

Pool Corp (POOL): Increased his investment in this swimming pool supplies and equipment company considerably by 48.2% vs. the last quarter (September 2024). Pool is now Buffett’s 30th largest investment.

Sirius XM (SIRI): Increased his investment in this satellite audio entertainment company by 11.7% by December 31, 2024, and (according to his subsequent SEC filing) by another 2.0% afterward. SIRI is now Buffett's 13th largest investment.

VeriSign (VRSN): Increased his investment in this internet infrastructure and domain name registry services company by 3.6% by December 31, 2024, and (according to his subsequent SEC filing) by another 0.1% afterward. VRSN is now Buffett's 12th largest investment.

Occidental Petroleum (OXY): Increased investment in this oil company by 3.5% by December 31, 2024, and (according to his subsequent SEC filing) by another 0.3% afterward. OXY is now Buffett's 6th largest investment.

New

Constellation Brands (STZ): This beverage company is a new investment, and with $1.2 billion, Warren Buffett’s 19th largest investment. As a side note, in the US, STZ holds the exclusive license to import, market, and sell the world-famous Mexican beer Corona.

My take is that Warren Buffett likely added the new company Constellation Brands (STZ) and increased his investments in Domino's Pizza (DPZ) and Sirius XM (SIRI) because these are all well-known consumer products/services companies that are essentially recession-proof.

The addition of Pool Corp. (POOL) may be an indication that he believes that the upper-middle-income segment will do well in the coming years.

As for Occidental Petroleum (OXY), not only is oil a good inflation hedge over the long-term, Buffett now owns over 28% of the company’s outstanding shares, giving him an important influence over the management of the company. For a recent company analysis of Occidental Petroleum (OXY), read this article “Buffett’s OXY: Company Analysis” here.

Additions of US Companies vs. Previous Quarter

Source: Berkshire Hathaway SEC Form 13F

5. Buffett’s Total Portfolio & Changes

As of his most recent SEC filing in February 2025 for the period ending on December 31, 2024, Warren Buffett's company, Berkshire Hathaway, owns shares in 38 companies. However, his portfolio is highly concentrated. The top 10 companies account for about 90% of his total invested portfolio.

The current ranking from 1 to 10 below is based on the latest known portfolio composition (as of December 31, 2024), ranked by market value as of December 31, 2024. Figures highlighted in orange indicate decreases, and those in green indicate increases. For 4 companies, Buffett also reported further changes made after December 2024; he added more shares for OXY (0.3%), VRSN (0.1%), and SIRI (2.0%), and reduced his holdings by 0.6% for Davita (DVA).

Warren Buffett’s Total Portfolio & Changes

Source: Berkshire Hathaway SEC Form 13F

Below are all the changes he made to this portfolio recently.

Exits (3 companies)

Exited 2 ETFs: VOO (Vanguard S&P 500 ETF) and SPY (SPDR S&P 500 ETF).

Exited Ulta Beauty (ULTA).

Reductions (9 companies)

Reduced his holdings in 4 banks/consumer finance companies (Citigroup, Nu Holdings, Capital One Financial, and Bank of America), as mentioned above in the section “Warren Buffett Sells Banks.”

Davita (DVA): Reduced his holdings by 0.6%, after the last reported quarter ending December 31, 2024.

T-Mobile US (TMUS): Reduced his holdings by 6.9%, during the last reported quarter (ending December 31, 2024).

Charter Communication (CHTR): Reduced his holdings by 29.4%, during the last reported quarter (ending December 31, 2024).

Liberty Media (FWONK): Reduced his holdings by 11.9%, during the last reported quarter (ending December 31, 2024).

Louisiana-Pacific (LPX): Reduced his holdings by 5.0%, during the last reported quarter (ending December 31, 2024).

Additions (6 companies)

Increased 5 companies (Domino’s Pizza, Pool Corp, Sirius XM, VeriSign, and Occidental Petroleum) and newly added Constellation Brands, as mentioned above in the section “Warren Buffett Adds 6 Companies.”

6. Summary

Warren Buffett is an exceptional investor. Based on his recent actions (record-high cash savings, etc.), Buffett seems to be concerned about challenging economic times ahead. Yet, in this environment, he still keeps making targeted investments in a few companies.

Key Investment Insights Based on Buffett's Actions in Recent Quarter:

The key insights have not changed much since the report about the previous quarter (ending September 30, 2024). Key insights 1 through 3 are unchanged. Key insight 4 is new.

Consider reducing exposure to recession-sensitive investments, such as consumer discretionary spending companies (e.g., Apple) or banks/consumer finance (e.g., Bank of America).

Think about increasing the cash portion of your portfolio to capitalize on potential investment opportunities during future market pullbacks.

Explore increasing exposure to the U.S. oil sector, with a focus on companies like Chevron and Occidental.

Explore adding recession-proof companies like STZ (which distributes Corona Beer), DPZ (Domino’s Pizza), and SIRI (which offers SiriusXM Satellite Radio).

Thank you for reading the article. Hope you enjoyed it.

Hungry for more? Subscribe to the newsletter - it's free and fabulous.Enjoyed this article? Don't keep it to yourself! Share it with a friend or two. They might even buy you a coffee as a thank you.Your Fringe Finance

Disclaimer

Neither the author nor Fringe Finance is a financial advisor or a tax professional. This article is for illustrative and educational purposes only and does not constitute a specific offer of any product or service.

Past performance of stocks and assets is not an indicator or guarantee of future performance of stocks and assets.

The information in this blog does not constitute an offer to buy or sell, or a solicitation of an offer to buy or sell, any of the securities mentioned herein.

We believe the information provided is accurate and current. However, we do not guarantee its accuracy and it should not be considered a complete analysis of the topics discussed.

Any opinions expressed reflect the author's judgment at the time of publication and are subject to change.

Seek guidance from qualified financial and tax experts before taking action.

Domino’s Pizza is the new bitcoin

Is he the buyer of the 30 million ounces ?