“Successful investing is about managing risk, not avoiding it.”

— Benjamin Graham

Not financial, investment, legal, or tax advice. Please read our full Disclaimer on the Disclaimer page. Accessible via the provided link and via the homepage menu. Continued reading constitutes your agreement to its terms.

Silver prices surged 70% to $39/oz in 2 years. Experts warn this is just the start of a historic shortage that could push prices to $500/oz. After a long slumber, it’s on the move, and people are making money—many expect to make even more. What’s driving it? What’s the projection? Is it complex to understand?

The answer is no. The silver market is not difficult to understand.

No AI or chip technology is involved; no deep technical analysis is needed. No special knowledge or education is required. Once you understand supply and demand, you’re good. Yes, there are subtopics within supply and demand, but at its core, it’s simple and straightforward.

Many legendary investors believe we’re at the start of a multi-year commodities supercycle, from silver and gold to uranium and beyond. Plenty of opportunities to make money lie ahead. We will cover other commodities in the weeks, months, and years to come. This is too juicy an opportunity not to become a commodities expert of some sort. I am not talking about a real scientist—just investors who understand supply and demand by commodity to profit from it.

Today, though, we focus on silver—the original money, made famous in the Bible (“30 pieces of silver”). Silver is critical in a number of important technologies like EV batteries and solar panels, and is used in many industries, including defense. It is a critical commodity, and its price has risen from about $23 to $39 over the last 2 years, and it is heading higher, much higher.

The gold-silver ratio is a crucial metric for investors in precious metals, representing the number of ounces of silver required to purchase one ounce of gold. Historically, the gold-silver ratio has varied significantly.

For instance, during the Roman Empire, the ratio was approximately 12:1, indicating that 12 ounces of silver could buy one ounce of gold.

More recently, the long-term average ratio was about 60:1.

That ratio reached an all-time high of over 110 in April 2020 amid the COVID-19 pandemic.

As of mid-2025, the ratio hovers around 88:1, further suggesting that silver is currently undervalued compared to gold.

Gold to Silver Ratio

Source: https://www.macrotrends.net/1441/gold-to-silver-ratio

Legendary gold and silver billionaire investor Eric Sprott recently said essentially the following (paraphrased), “I think that ultimately silver prices of $250 to $500 per ounce are entirely possible.“ Fast forward to time stamp 6:30 to listen to that.

Back to the silver market analysis. Commodity analysis boils down to analysis of supply and demand, including existing inventories. When demand exceeds supply, prices go up. If the price drops below production costs, producers drop out, and prices can explode once inventory runs out. It’s all about supply and demand. Once you understand that, you are good; there is no new technology to learn. Silver is silver; copper is copper. Nothing changes.

Of course, supply and demand sounds so academic. So boring. It is, until it hits you in your personal life. We may not know the causes, but notice 2 things in those instances. People get frantic and want it even more, and prices go up.

It is the same with silver. If the annual demand for silver exceeds the annual supply of silver, it drives prices up. Of course, with demand and supply, the devil’s in the details.

If supply is limited, can, for instance, recycling help? Can high prices lead to substitution, like PVC pipes instead of copper pipes? Nevertheless, ultimately, it’s all about simple demand and supply. Easy to understand, easy to project, and easy to profit from, whether buying the metal, ETFs, miners, or options.

Today, we’ll explore the exciting silver market.

Global Silver Supply

Global Silver Demand

The Annual Silver Supply Deficit & Inventory Changes

The Paper Silver Market and Allegations of Price Suppression

Investment Opportunities in the Silver Market

Key Takeaways

Let’s start with the silver supply.

1. Global Silver Supply

1.1 Mined Silver Supply

Silver is typically produced as a byproduct of mining other metals such as lead, zinc, copper, and gold. As a result, many companies involved in silver mining generate only a fraction of their revenue from silver itself.

For example, Pan American Silver (PAAS) is a famous silver mining company. Yet, it only earns around 25% of its revenue from silver. This is common among silver mining companies. An informal benchmark considers mining companies with at least 25% of their revenue derived from silver as silver miners. There are a few exceptions, like Hecla Mining (HL), which derives about half of its revenue from silver, but such cases are rare. Understanding these nuances helps investors better understand the true exposure of silver mining companies to silver price changes.

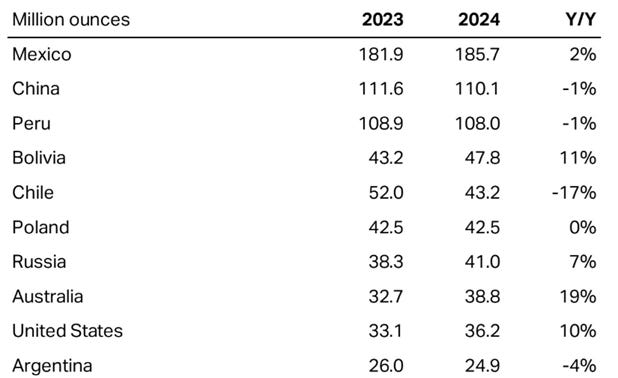

The top 10 silver producing countries, in order, are: Mexico, China, Peru, Bolivia, Chile, Poland, Russia, Australia, US, and Argentina.

Top 10 Silver Producing Countries

Source: https://silverinstitute.org/silver-supply-demand/

1.2 Recycled Silver Supply

Recycling, from an everyday use, is typically seen as an environmental measure—a nice thing to do. For silver, it is different. Silver is in short supply, and what is coming from the mines is not sufficient. Recycling for silver is a critical part of the global silver supply. In 2024, recycling contributed about 20% (19.1%) of the global silver supply. That is a significant source of silver.

As silver mining supply is not expected to provide enough silver to meet the demand, the need for silver recycling will increase. And as silver prices continue to rise, even more expensive silver recycling projects will become profitable.

It wouldn't surprise me to see silver miners eventually enter the recycling space as an additional revenue source, but that is just my speculation. Irrespective of who does it, silver recycling will continue to play an important role in the global silver supply.

1.3 Production Costs Above Market Value – Not an Issue with Silver

If you are a miner, to state the obvious, if it costs you $10 to produce an ounce of silver, but the market price is $5, then you obviously shut down production. I know, salespeople are known to sometimes say, “We lose money on every sale, but we make it up in volume,” but kidding aside, the rational thing to do is for a miner to shut down production for the time being in those circumstances.

That was the case until a few years ago in the uranium market. The uranium supply essentially shut down. There was a huge supply of already mined uranium stored away. Uranium was selling at about $20 per pound, but extraction costs for new uranium were about $50 per pound. In that situation, the smart play is to shut down production, wait for the demand to eat through the existing inventory, and once the inventory is gone, prices will go up (a lot), and at that time, one can restart production. Well, that is what happened.

This dynamic has not been an issue in the silver market, as silver is largely a byproduct, and its production costs generally tended to be below the market value of silver.

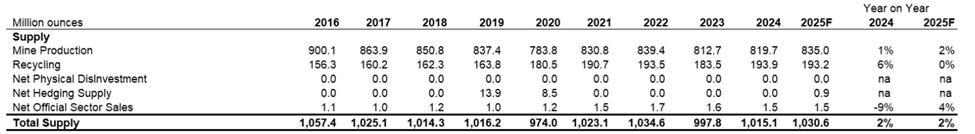

1.4 Total Silver Supply

According to the Silver Institute, global silver mine production in 2024 reached 819.7 million ounces (Moz), a modest 1% increase from the previous year. Factoring in other sources, including recycling, total silver supply in 2024 was 1,015.1 million ounces (Moz). Or expressed in billion ounces, the total silver supply in 2024 was 1.015 billion ounces.

That supply is expected to grow by about 2% in 2025.

Silver Supply (Million Ounces)

Source: https://silverinstitute.org/silver-supply-demand/

We discussed the silver supply. Let’s discuss the other side, the silver demand side.

2. Global Silver Demand

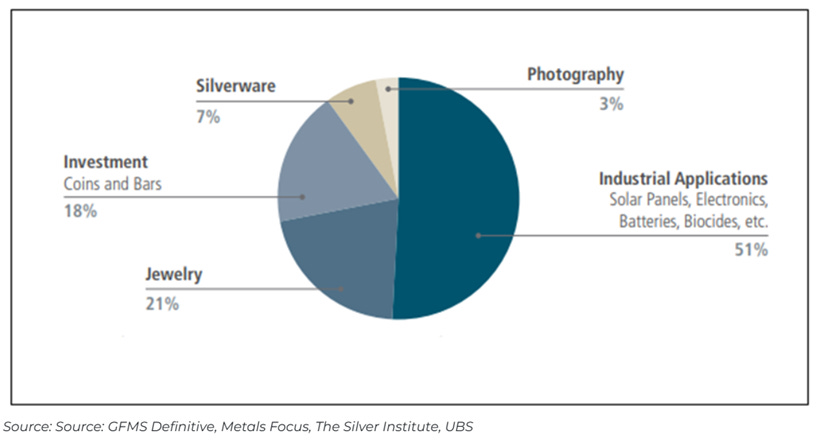

If the use of silver were just for jewelry, silverware, and coins, a silver shortage would be an inconvenience, but not a problem. Silver, however, is critically needed in a number of industrial sectors—from the defense industry to electronics to the renewable energy industry. Silver is needed.

Silver Demand by Industry/Type

Source: https://www.mining.com/silver-market-fundamentals-strong-as-it-enters-a-new-era-of-supply-deficits/

In 2024, global silver demand reached 1.164 billion ounces, which was higher than the 2024 silver supply. More about the supply side later. Let’s talk about the silver demand first.

2.1 Industrial Demand

Silver is a critical component in many industrial uses, in particular in the area of clean energy transition. An area that many countries around the world actively pursue.

Here is an article about silver’s critical role in the clean energy transition.

Source: https://sprott.com/insights/silver-s-critical-role-in-the-clean-energy-transition/

Below are examples of how silver is used in various industrial sectors.

Electronics - Silver’s unmatched electrical conductivity makes it essential for circuit boards, smartphones, and laptops.

Solar Energy - The solar-powered sector is a major driver of silver demand.

Electric Vehicles (EVs) - EVs use silver in batteries and throughout the car. You can read more about it here: https://www.kitco.com/opinion/2024-06-28/silver-and-ev-revolution

Other Industrial Uses - Silver is, for example, used in medical applications due to its antibacterial properties.

2.2 Silver Military Demand

While less often stated due to the sensitive nature of these uses, military applications, including weapons systems, satellites, and aerospace, also consume large amounts of silver.

“Some experts believe that military demand for silver could be up to 15 times greater than any other industry.”

The military side of the total silver demand isn’t mentioned much, as the immense silver demand from EVs and solar energy portrays a nicer image of the silver industry, but as military warfare gets more high-tech, so goes up the military silver demand.

2.3 Jewelry and Silverware

Jewelry and silverware are another strong source of demand, and the global demand varies strongly. China is the largest jewelry consumer market globally, leading in both gold and silver jewelry demand due to its massive population and growing middle class. India is the second-largest jewelry market globally, and historically one of the biggest consumers of silver jewelry worldwide thanks to its cultural affinity for silver in ornaments and accessories.

The US is the third-largest jewelry market, and has a strong silver jewelry demand as an affordable precious metal option.

2.4 Physical Silver

Demand for silver coins and bars is another strong demand source.

2.5. Silver Substitutes

What typically happens if a product gets too expensive is that consumers switch to a substitute product. For example, if beef becomes too expensive, many people switch to chicken.

As silver prices increase, the hunt for substitutes, where possible, will be on, in addition to new technologies that require less silver. As a silver investor, this is something to monitor, but to my knowledge, it is not a realistic option yet.

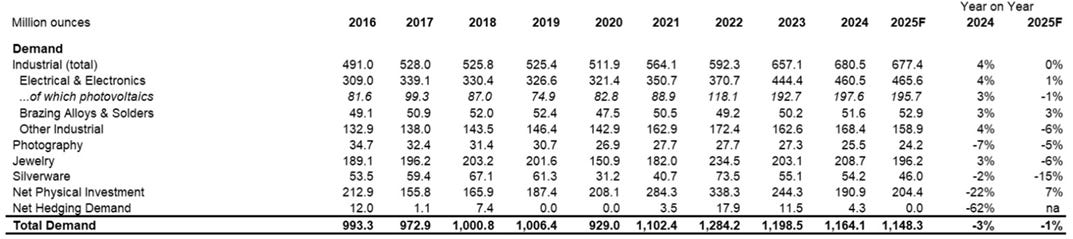

2.6. Total Silver Demand

Total silver demand in 2024 was 1,164 million ounces (Moz). Or expressed in billion ounces, the total silver demand in 2024 was 1.164 billion ounces. That demand is expected to decline by about 1% (very little) in 2025.

Source: https://silverinstitute.org/silver-supply-demand/

Above we discussed the silver supply and silver demand. Let’s bring it all together.

3. The Annual Silver Supply Deficit & Inventory Changes

In 2024, global silver demand exceeded the global silver supply by about 15%. Here are the details for 2024:

Total Supply: 1,015 million ounces (Moz)

Total Demand: 1,164 million ounces (Moz), meaning demand was about 15% higher than supply

Total Shortage: 149 million ounces (Moz)

Markets Are Funny – A Small Demand/Supply Gap Can Have A Large Impact

15% higher demand than supply sounds too technical. It may not sound like much. But markets are funny that way, in that small changes can change the market dynamics and the pricing radically. A small change in the demand/supply ratio can have an outsized impact. Much more than one would expect.

Imagine a small town where there’s a dance party, and at first, there are exactly 10 men and 10 women. Since the numbers are equal, everyone has a good chance of finding a dance partner. Nobody feels too rushed, and people can take their time choosing who they want to dance with. Now, what if just one woman leaves the party, and one extra man shows up? Now it’s 11 men and only 9 women. That small change makes a big difference!

The men now have fewer women to choose from, so they start competing harder to get a dance partner.

The women become more "in demand" because they’re outnumbered—some men might even offer to do nice things (like buy them a drink) just to get their attention.

A couple of men might end up without a partner at all, even though only two people (one woman leaving, one extra man arriving) changed the whole dynamic.

The silver market works in a similar way. Even small changes in demand (how many people want to buy it) can make prices swing a lot.

If suddenly more companies need silver for things like solar panels (increasing demand), but miners can’t produce more fast enough (limited supply), the "competition" for silver heats up—just like the extra men fighting for fewer dance partners.

That pushes prices higher because buyers are willing to pay more to get the silver they need.

Just like in the dance party, a small percentage mismatch between supply and demand can cause big changes in who gets what—and at what price.

3.1 Annual Silver Supply Deficit

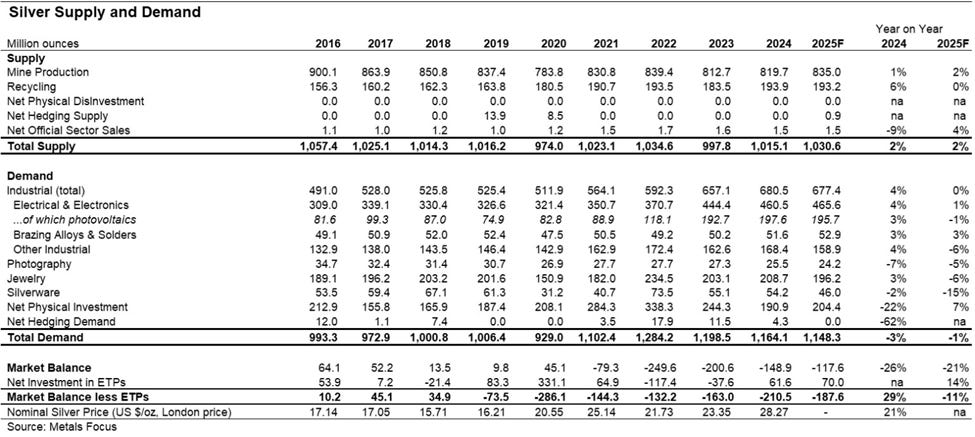

Silver Supply and Demand (Million Ounces)

Below is a table showing the annual supply versus demand for silver globally, by source of such supply and demand.

Source: https://silverinstitute.org/silver-supply-demand/

The silver market has faced structural deficits for several years, since 2021. Every year since 2021, the demand for silver has been stronger than the supply of silver. The cumulative deficit from 2021 to 2025 is estimated to be at 800 Moz, equivalent to a full year of global mine production.

Without significant new mine discoveries, technological breakthroughs in recycling, or substitute products for silver, silver deficits could continue beyond the decade, potentially pushing prices higher.

3.2 Silver Inventory

You cannot consume what does not exist. Since silver demand has exceeded silver supply since 2021, the fundamental question arises: where is this supply gap being filled from?

Above-ground silver inventories have played a critical role in moderating the impact of these deficits. The World Silver Survey 2025 provides detailed data on identifiable bullion inventories, which include stocks held in London vaults, the Chicago Mercantile Exchange (CME), Shanghai Futures Exchange (SHFE), Shanghai Gold Exchange (SGE), and other exchanges.

At the end of 2024, these inventories totaled 1,239.2 million ounces, marking a 1% increase year-on-year despite the market deficit. Given that the silver supply is less than the silver demand, this increase suggests that silver was released from unreported inventories.

Source: https://silverinstitute.org/wp-content/uploads/2025/04/World_Silver_Survey-2025.pdf

The World Silver Survey 2025 (link above) makes the case, in its 2025 report, that the current state of above-ground inventories is no cause for alarm. They say:

“With little signs of an imminent physical tightness, it is difficult for institutional investors to become too excited about silver’s fundamentals.”

“…we feel that a few more years of deficits are needed first to further erode above-ground silver inventories.”

3.3 Silver Inventory Challenges – It is worse than it looks.

Respectfully, I believe, the World Silver Survey paints too rosy a picture. The total silver inventory is roughly equal to 1 year of demand. That is hardly confidence inspiring.

Plus the inventory at the exchanges is not in all cases freely available. In many cases, it functions as collateral for paper silver (ETFs) or similar products. They may lease out the silver for a limited time, but that silver needs to be returned. And from where exactly? All this points to a sustained silver demand/supply imbalance (i.e., supply shortage).

Since we now have a better understanding of supply, demand, and inventories in the silver market, let’s talk about a controversial topic – silver market manipulation – that many silver investors feel passionate about.

4. The Paper Silver Market and Allegations of Price Suppression

As mentioned, this is a controversial topic. Yet, to be comprehensive in the analysis of the silver market, one needs to talk about how many silver investors affectionately call “Mr. Slammy.”

Mr. Slammy is a code word for the collective efforts of certain market players to put downward pressure on silver prices. For the purpose of writing this section, I will assume Mr. Slammy to exist, but please note that while it seems true to many based on observations of how the market behaves and stories shared by people involved in silver trading, there is no evidence to confirm it. If true, however, it would explain a lot of strange silver price movements.

The paper silver market, encompassing futures, options, and exchange-traded funds (ETFs), allows investors to gain exposure to silver prices without holding physical metal. However, the paper silver market has been rumored to be manipulated in order to suppress the silver price, with the term “Mr. Slammy” referring to large-scale selling in futures markets that allegedly manipulates prices downward. Critics argue that this activity benefits certain financial institutions and industrial users by keeping silver prices artificially low.

Many silver investors swear by it.

Yet others say it doesn’t exist.

4.1 The Manipulation Mechanics

The silver market manipulation, often referred to as "Mr. Slammy," works by large financial players flooding the market with these large paper silver sales, creating an artificial supply glut, which forces prices down. This suppression discourages current investors and deters new buyers, preventing upward momentum.

One crucial aspect of this manipulation is that most silver futures contracts settle in cash rather than requiring physical delivery. This means that those selling large amounts of paper silver do not need to provide or take possession of actual metal, making it easier and cheaper to conduct these price-suppressive actions.

Because physical silver is often scarce relative to the volume of paper claims, the markets for physical silver and paper silver are separated, enabling manipulators to influence prices through the much larger paper market without necessarily holding or moving the physical commodity.

Banks and central banks involved in these manipulative practices are willing to accept short-term losses or "take a hit," probably either on behalf of their industrial customers or other players, because silver is a critical industrial metal linked to national security interests, such as electronics, defense, and renewable energy technologies.

And every once in a while the market manipulation gets too obvious, and there are fines and penalties. Large sums for sure, but they pale in comparison to the silver savings accomplished by putting downward pressure on the silver.

Their willingness to endure short-term losses reflects the strategic importance of silver in industrial and national security contexts, making price control a priority that outweighs immediate financial costs.

As explained below in section 5.2, price manipulation can’t keep the price down forever. Eventually, if the demand keeps pushing and supply just isn’t there, the price catches up, and then typically in an explosive way.

4.2 The Effect of Keeping Prices Low (Microeconomic Forces at Play)

No one likes high prices, but prices serve an important purpose. They help us decide how to use limited resources. For example, imagine beachfront houses in Palm Beach, Florida, selling for only $100,000 each. Many people would want to buy them, but there wouldn't be enough houses for everyone. To fix this, prices would naturally go up until the number of buyers matches the number of houses available. This is called the market price. If you've taken a microeconomics course, you might remember this as the market price is where supply meets demand.

Prices help distribute products efficiently when resources are limited. However, if prices are kept artificially low, people tend to use more of the product than they normally would, which can lead to shortages. For example, if silver prices are kept artificially low, people might buy and use more silver than they should, making shortages worse.

While market manipulation might work temporarily, in the long run, reality catches up. Eventually, silver prices will need to rise to reflect true supply and demand. When prices go up, people who use silver might look for alternatives, like another metal or new technology that uses less silver. As silver becomes more expensive, this will reduce demand, and prices will stabilize at a higher level.

To prevent sudden silver shortages, assuming the silver market is manipulated, it's likely that silver prices will be allowed to increase gradually over time. This slow rise would give industries enough time to adjust and avoid major disruptions, allowing the market to find a fair, not manipulated, price level.

What we will most likely see in the years to come is a steady, and at times rapid, increase in the price of silver. However, that is just their plan. Considering how aggressively the silver market has increased in price over the last two years, it seems the market manipulation is getting away from the manipulators. And we might see even faster price increases.

Life is like chess. Different players are more powerful than others, with the Queen being the most powerful piece.

But even the Queen, powerful as she is, is not all-powerful. And that is what I believe we are seeing in the silver market. The market manipulators, powerful as they are, are not all-powerful. The demand forces are getting too strong, and silver prices might continue to go up and even bounce up in a powerful way. Factoring in the sheer giddiness of legendary investors in this silver space like Jim Rogers, Rick Rule, Eric Sprott, and others, that would seem to be a fair assumption.

And that is just the silver price increase due to supply/demand changes. Once you factor in the continued inflation factor, as explained in the article “How Smart Investors Get Rich From Inflation (While Everyone Else Suffers) - Turn Rising Prices Into Profits: Strategies That Work,” that will further turbo-charge the price of silver. And it already started.

Since we now covered supply, demand, inventory, and rumors of market manipulation, and touched on the impact of inflation, let’s bring it all together by talking about the amazing investment opportunities in the silver market.

5. Investment Opportunities in the Silver Market

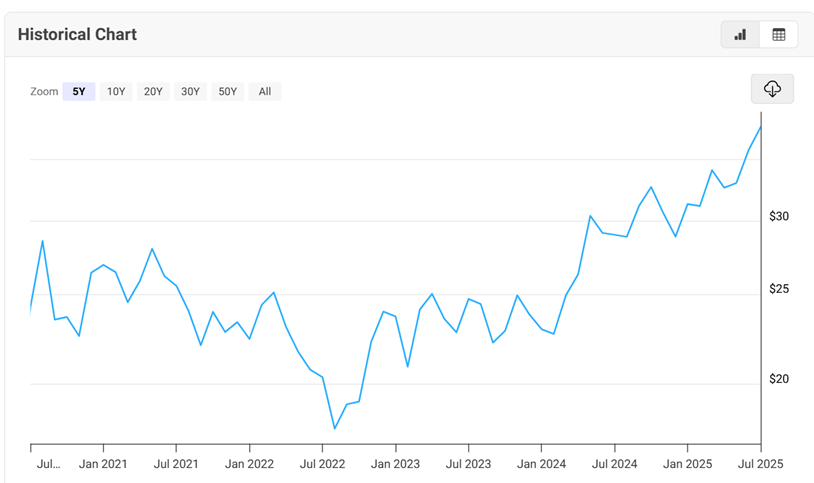

The last 1.5 years has been exciting for silver investors. Silver went up from around $25 per ounce in early 2024 to about $39 in July 2025, and many legendary investors like Jim Rogers, Rick Rule, and Eric Sprott are expecting even higher silver prices. Much higher silver prices.

Silver Price History

Source: https://www.macrotrends.net/1470/historical-silver-prices-100-year-chart

So how can we profit from it?

There are multiple ways to profit from this, from simple investments that allow you to grow your silver holdings 1:1 with the increase in silver prices, to more complex investments and strategies that enable you to profit much more, with returns of up to 20 or even 100 times what was invested.

This is the kind of silver market that makes even legendary gold and silver investors like Rick Rule and Eric Sprott giddy with excitement.

Let’s explore these investment options.