“You will never get anywhere if you do not do your homework.”

— Legendary Investor Jim Rogers

Chevron is a Texas-based (previously California-based until 2024), 2nd largest oil company in the US, and it is the 5th largest investment of legendary investor Warren Buffett. In addition, Chevron is a member of the exclusive Dividend Aristocrats – a small elite group of dividend stocks with 25+ years of consecutive dividend increases. Read more about Dividend Aristocrats here. In many ways, Chevron, as an oil company, offers many great advantages – but more about that further below.

The US oil industry is fascinating and goes back a long way. From Native Americans, to Pennsylvania, to John D. Rockefeller, to the breakup of Rockefeller’s massive oil company Standard Oil by the US Supreme Court, to today where the successors of Standard Oil make up today’s US oil companies (Exxon, Chevron, Occidental Petroleum, etc.).

Let’s go back to the beginning.

Native Americans harvested crude oil from natural seeps (oil that made it naturally to the surface) and used it as mosquito repellent, waterproofing, and body paint for religious practices.

Early-day settlers in the US used mainly animal fats and whale oil as the primary lubricant for their horse carriages, with very limited demand for crude oil.

However, that changed when kerosene lamps became popular in the mid-19th century to light homes. In 1851, Samuel Kier developed a method to distill crude oil into oil that could be used for kerosene lamps, and he built America’s first oil refinery in Pittsburgh.

After that, things moved fast; in 1859, Edwin Drake drilled the first successful oil well in the US in Pennsylvania. The first oil pipeline began operating in Pennsylvania in 1863. All this led to a frenzy of drilling activities across Pennsylvania and other states. Think of it as an earlier version of the dot-com craze of the early 2000s or the ongoing crypto craze.

In 1870, the now-famous John D. Rockefeller, recognizing the potential, founded Standard Oil, a refining company, and it established itself quickly as the leading refining company in Pennsylvania and across the US.

By 1879, Standard Oil controlled 90% of the US’s refining capacity.

That is where we meet the beginnings of Chevron. Chevron began in 1879 as the Pacific Coast Oil Company, where it quickly became California's largest oil company. However, it didn’t stay independent for long. Rockefeller’s Standard Oil acquired it in 1900 and later renamed it Standard Oil of California. However, following concerns that Standard Oil had become a monopoly and too powerful, in 1911, the US Supreme Court broke up Standard Oil into 34 independent companies.

One of these 34 companies was Standard Oil of California, which later became Chevron. In 1984, Chevron acquired Gulf Corp, which was the largest corporate deal in history at the time. In 2001, Chevron merged with Texaco and briefly changed its name to ChevronTexaco Corp, before reverting to Chevron in 2005 after acquiring Unocal Corporation. In 2023, Chevron acquired Hess Corporation, continuing its acquisition strategy. On a side note, all these acquisitions, with the exception of Unocal, were one of the 34 companies that Standard Oil had been broken into back in 1911 – partially completing the full circle from a full break-up to a partial re-consolidation.

In the graph below, you can see a partial picture of what happened to the 34 companies. Standard Oil laid the foundation for today’s US oil industry, with Chevron being one of them.

Source: https://www.visualcapitalist.com/chart-evolution-standard-oil/#google_vignette

Chevron is now the 2nd largest oil company in the US.

Company Analysis Preview

I will be analyzing the company in three steps:

Market

Company & Competition

Financial Performance, Stock Valuation & Dividends

Let’s take a closer look.

1. Market

The oil and gas industry is a global industry. Oil is shipped around the world, while gas is more complex, often requiring pipeline transport or liquefaction for shipment as liquefied natural gas.

As the chart below shows, global energy consumption is growing, and whenever a new energy source appears, it is simply added to the existing energy sources without reducing older sources such as coal, oil, and gas. For better or worse, the importance of oil, gas, and coal in the global energy mix cannot be overstated—and barring something dramatic, it is likely to remain so.

The quote often attributed to Mark Twain, "The reports of my death are greatly exaggerated," applies very well to the global oil and gas industry. Please note that this is a description of reality, not a value statement for or against oil and gas.

Source: https://ourworldindata.org/energy-production-consumption

Except for periods of recession, which temporarily reduce economic activity and thus reduce demand for all energy sources, including oil and gas during the recession, the outlook for the industry remains cautiously optimistic.

You can read more about the oil market here in section “2 of 5 – Market Analysis” of the article “Buffett’s OXY: Company Analysis.”

2. Company & Competition

Chevron is a massive US oil company. As noted above, and as the table below shows, Chevron is the 2nd largest oil company in the US.

List of Top 10 Oil and Gas Companies in America (based on market cap in 2025)

Company

When we talk about oil companies, we can look at their business in three parts: upstream, midstream, and downstream. This sounds more complex than it is. Upstream is all about finding and extracting oil and gas. Midstream is the transportation, storage, and processing of oil and gas. Downstream is the final part and includes turning oil and gas into final products such as diesel and gasoline and selling those products to consumers.

Chevron (CVX) is an integrated energy company, meaning that it operates in all three segments, but it is mainly engaged in the upstream and downstream businesses. Roughly 75% of the revenue comes from the low-margin downstream business, with the remainder coming mainly from the high-margin upstream business. More about this below in the financial section.

As the second-largest US oil company, Chevron is massive with business operations all over the world.

“Chevron Corporation is a global energy company with direct and indirect subsidiaries and affiliates that conduct substantial business activities in the following countries: Angola, Argentina, Australia, Bangladesh, Brazil, Canada, China, Egypt, Equatorial Guinea, Israel, Kazakhstan, Mexico, Nigeria, the Partitioned Zone between Saudi Arabia and Kuwait, the Philippines, Republic of Congo, Singapore, South Korea, Thailand, the United Kingdom, the United States and Venezuela.”

Source: 2023 Annual Report Chevron (CVX)

Upstream Business

As per the latest available annual report (2023), CVX’s upstream operations produce about 3.1 million oil-equivalent barrels per day, which is roughly 1.1315 billion oil-equivalent barrels per year. Given Chevron’s proven reserve of roughly 11.1 billion oil-equivalent barrels, that translates into a reserve of 9.81 years. (I explain about the metric “barrels of oil equivalent (BOE)” in this article about Occidental Petroleum.)

According to E&Y, the average reserves-to-extraction/production ratio for U.S. oil and gas companies is about 9.82 years for oil and 11.43 years for natural gas, which means Chevron is exactly at average.

Source: https://www.ey.com/en_us/insights/oil-gas/oil-and-gas-industry-trends.

Roughly 60% of the reserves are in the US, and the remaining 40% are located all over the world.

Chevron: Net Proved Reserves for Years 21, 22 and 23

Source: 2023 Annual Report Chevron

Downstream Business

Chevron’s downstream business generates about 75% of the company’s revenue and about 25% of the company’s income, as the downstream business is a low-margin business. The downstream business, by revenue, is roughly 50/50 between the US and International.

3. Financial Performance, Stock Valuation & Dividends

In the company analysis snapshot below, you can see the major relevant indicators: Stock Price History, Dividend Payment History, P/E Ratio History, Dividend Yield History, Annual Revenue History, Annual Net Income History, Profit Margin History, and Debt Ratio History.

But before we go there, let’s discuss an aspect of oil companies that is very important in the current environment of continued inflation concerns, which adds a lot to the valuation of an oil company.

If history repeats itself, and it looks like it will, oil prices should continue to rise in line with inflation, turbo-charged (as in the past) by a deteriorating supply/demand oil balance. Good for any investor in oil companies like Chevron - an effective inflation hedge similar to gold and silver, with annual dividends while you wait.

I covered this topic of oil being an inflation hedge in more detail in this article about Occidental Petroleum (read section “Oil Companies as an Inflation Hedge” under “4 of 5 – Valuation”).

Here are the key insights from that section:

In 1950, a barrel of oil cost $2.51. That price was in 1950 dollars. Since then, the value of the dollar has fallen because of inflation.

Adjusted for inflation, the 1950 price would be about $32.74 in 2024 dollars. That is a 13-fold increase due to inflation.

Today, a barrel of oil sells for about $82.00. This increase from $32.74 to $82.00 is a 2.5-fold increase. This increase is due to non-inflationary factors, mostly due to changes in supply and demand.

This means that historically oil has been a good inflation hedge. The price has been turbo-charged by the deteriorating supply/demand balance since 1950.

Here is a snapshot of the financial performance analysis of Chevron.

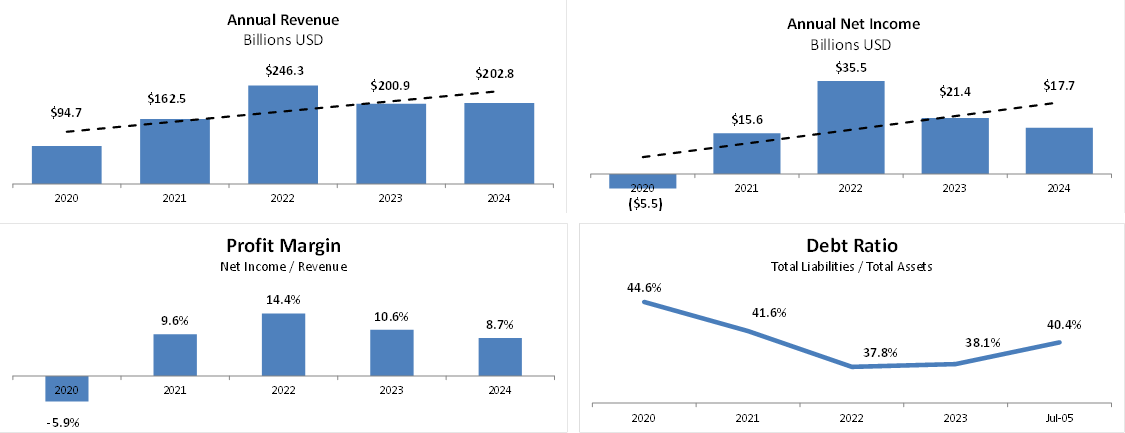

Financial Performance

As one would expect, the revenue and net income of an oil company are heavily driven by the global oil price. Very low oil prices due to the Covid pandemic led to losses for most oil companies in 2020. Conversely, record high oil prices in 2022 led to great financial performance for most oil companies in 2022, followed by decreasing profitability in 2023 and 2024 as oil prices came down.

Oil Prices – Historical Chart (price per barrel)

Source: https://www.macrotrends.net/1369/crude-oil-price-history-chart

Let’s see how Chevron did.

Revenue: Since 2020, annual revenue has been on an overall upward trend, spiking in 2022 in the year of record-high oil prices, coming down in 2023 and increasing in 2024.

Net Income & Profit Margin: After a rapid increase from 2020 to 2022, spiking in 2022, both net income and profit margin came down significantly. This was mainly driven by the composition of the business. CVX has essentially two major business lines – an upstream business line with an average profit margin of about 40% and a downstream business line with an average profit margin of about 4%. Based on the 2023 Annual Report, the revenue composition since 2021 has been moving towards the low margin downstream business. I believe to partly address this, Chevron recently announced that it will reduce its global workforce by 20% (see below the article link).

Debt: The company is managing the amount of debt responsibly. The company reduced its debt rapidly from 2020 to 2022. While the debt has been creeping up slightly from 2022, the increase has not been material and is still below 2020 and 2021.

Stock Valuation (P/E Ratio and Outstanding Number of Shares)

P/E Ratio: For a mature company like CVX, the P/E ratio is a perfect measure to see how expensive or cheap it is. Let’s first take a look at the benchmark for this industry. That would be the ETF "The Energy Select Sector SPDR Fund (XLE)," which currently has a P/E ratio of about 15.17. Chevron is currently running at a P/E ratio of about 16.3, meaning it is slightly higher than the benchmark and on the high side compared to its own P/E history. In a nutshell, on a P/E ratio basis, Chevron is fairly priced – maybe slightly overpriced.

Outstanding Number of Shares: Chevron has been reducing the shares outstanding by about 3% from 2022 to 2023 and again by about 3% from 2023 to 2024, which makes each outstanding share more valuable.

Dividends

The dividends (in dollar terms) have increased year after year for at least the last 25 years, as you would expect from an S&P Dividend Aristocrat company.

Chevron’s current dividend yield is 4.35%. This is comparable to current 5-year US Treasury Bonds (source: https://www.bloomberg.com/markets/rates-bonds/government-bonds/us). Not bad. The difference, of course, is that with Chevron stock, if it stays a Dividend Aristocrat, your subsequent dividend yields will keep growing, and there is the very strong possibility of further stock price increases on top of it.

Of course, your exact starting dividend yield and subsequent, growing dividend yields (if Chevron remains a Dividend Aristocrat) will depend on what the stock price was when you purchased it. Read more about the starting dividend yield and subsequent dividend yields below.

The best time to buy Dividend Aristocrat companies like Chevron is to look at the long-term average dividend yield and purchase the stock ideally when the dividend yield is at a historic high.

Starting Dividend Yield and Subsequent Dividend Yields

If you buy a 10-year US Treasury, you get the same interest payment (annual payment) every year, and you get your investment back at the end of 10 years.

With an S&P Dividend Aristocrat company, your dividend payment grows every year, meaning your yield compared to your starting yield grows year after year, based on your purchase price.

Let’s look at Chevron as an example. Assume you purchased Chevron back in 2011. Back then, the average stock price was around $78.14 and the annual dividend was about $2.846, giving you a dividend yield of 3.63%. Since S&P Dividend Aristocrats increase their dividend payment in dollar terms year after year, your dividend yield will increase (compared to your purchase price) year after year. If you held onto that Chevron purchase until 2024, in 2024, your dividend yield would have been 8.34%.

This increase in dividend yield is true for any entry point. In other words, no matter when you buy Chevron, as long as the company remains a Dividend Aristocrat (meaning it keeps increasing its dividends in dollars), your subsequent dividend yields will keep growing. Especially if you are living off dividends, this is helpful to offset any price increases of goods due to inflation. The only thing that remains fixed is your starting dividend yield. Thus, if it is possible at all, wait for a good entry point when the dividend yield (vs market price) is at a historic high.

Summary

Chevron (CVX) is the 5th largest investment of legendary investor Warren Buffett and an S&P Dividend Aristocrat company with a current dividend yield of about 4.35%.

Chevron seems fairly priced on a P/E basis, and oil, like gold and silver, is a good inflation hedge. If history repeats itself, and it looks like it will, oil prices should continue to rise in line with inflation, turbo-charged (as in the past) by a deteriorating supply/demand oil balance.

This is good for any investor in oil company stocks like Chevron—an effective inflation hedge similar to gold and silver, with annual dividends while you wait. And in the case of Chevron, the dividends (and your dividend yields) will very likely keep increasing.

As any investor knows, there are no certainties, only probabilities, but the probabilities look good for the oil sector.

Thank you for reading the article. Hope you enjoyed it.

Hungry for more? Subscribe to the newsletter - it's free and fabulous.Enjoyed this article? Don't keep it to yourself! Share it with a friend or two. They might even buy you a coffee as a thank you.Your Fringe Finance

Disclaimer

Neither the author nor Fringe Finance is a financial advisor or a tax professional. This article is for illustrative and educational purposes only and does not constitute a specific offer of any product or service.

Past performance of stocks and assets is not an indicator or guarantee of future performance of stocks and assets.

The information in this blog does not constitute an offer to buy or sell, or a solicitation of an offer to buy or sell, any of the securities mentioned herein.

We believe the information provided is accurate and current. However, we do not guarantee its accuracy and it should not be considered a complete analysis of the topics discussed.

Any opinions expressed reflect the author's judgment at the time of publication and are subject to change.

Seek guidance from qualified financial and tax experts before taking action.