Billionaire Chris Hohn: Insights from a World's Leading Fund Manager

Exploring TCI Fund Management's Winning Strategies and Portfolio Highlights

“Success leaves clues; follow the footsteps of those who have already achieved what you desire."

— Unknown

Legendary investor Chris Hohn of TCI Fund Management has been crowned the No. 1 hedge fund manager by Institutional Investor for his stellar performance in 2023, after hitting some headwinds in 2022.

Chris Hohn is a legendary investor with a surprisingly low public profile. While high-profile investors like Warren Buffett and Jim Rogers are household names, Hohn prefers to keep a low profile. Nevertheless, he is a powerhouse in philanthropy, generously donating significant sums to The Children's Investment Fund Foundation. Founded by Hohn and his wife in 2002, this charity is focused on transforming the lives of children in poverty across developing countries. Today, it ranks among the world's leading charities, having assets of about $6.6 billion.

This article dives into Chris Hohn’s most recent portfolio update as of December 31, 2024, based on his 13F quarterly filing with the US Securities and Exchange Commission (SEC).

In this article, I will cover the following topics:

A Detailed Look at the Portfolio Changes from Last Quarter

Finance Sector Investments

Industrial & Technology Sector Investments

Foreign Investments

Summary & Key Investment Insights

Let's take a closer look.

1. A Detailed Look at the Portfolio Changes from Last Quarter

Chris Hohn has a remarkably concentrated portfolio, with the entire amount of a staggering $42 billion invested in just 9 companies. His investment philosophy mirrors that of Warren Buffett, who famously remarked,

“Diversification is protection against ignorance. It makes little sense if you know what you are doing."

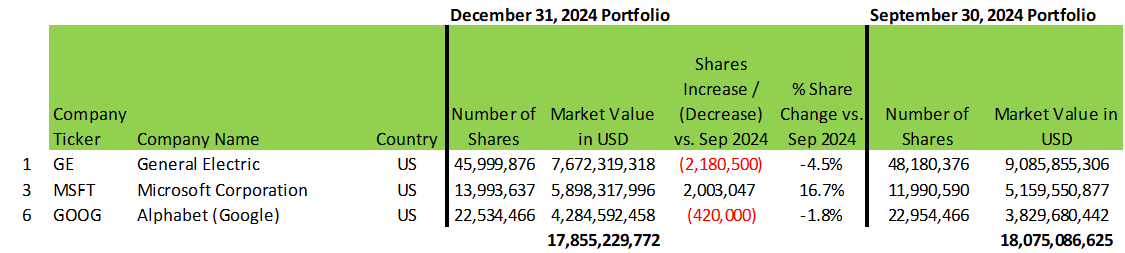

In the latest reported quarter ending December 31, 2024 (according to his 13F SEC filing), Hohn made some strategic moves: he ramped up investments in two companies, Microsoft and Ferrovial, while trimming his stakes in three others—General Electric, Google, and Canadian National Railway. Otherwise, interestingly, he neither exited any investments nor dove into new ones, showcasing his focused approach.

Of his 9 investments, 6 are US companies, 2 are Canadian companies, and 1 is a European company. Sorted by market value, his top 6 investments are all US companies.

Chris Hohn’s Total Portfolio & Changes

Source: TCI Fund Management 13F SEC Filing

As highlighted earlier, this article takes a closer look at Chris Hohn’s latest 13F quarterly filing with the SEC, as of December 31, 2024. These filings are required for large professional investors managing more than $100 million in US equities, and offer a treasure trove of insights for savvy investors hunting for winning strategies.

However, like most things in life, they are not perfect. For instance, they only cover securities listed on US stock exchanges, excluding foreign stocks acquired outside the US, as well as bonds, preferred stocks, derivatives, private equity positions, and cash.

That said, the 13F filing does include foreign stocks traded on US exchanges.

In essence, 13F filings are a goldmine of information for US investors and those accessing the US stock market, providing invaluable insights for anyone seeking solid investment opportunities.

Chris Hohn invested in Google (Alphabet) shares that come with voting rights (GOOGL) and those that do not (GOOG). To simplify the analysis, I combined the two types and treated them all as GOOG shares.

Coming back to the portfolio, what is to note is that this portfolio includes companies from various sectors and regions. It includes companies from technology (MSFT, GOOG), finance (MCO, V, SPGI), and industrials (GE), as well as companies from Canada (CP, CNI) and the EU (FER).

Overall, the selected companies all have strong market positions and sound business fundamentals, suggesting that Chris Hohn is pursuing a well-rounded investment strategy that balances growth and stability across various sectors and geographies.

Some companies are not well-known to the general public, like Moody’s (MCO) and Standard & Poor’s (SPGI), but they are hidden finance gems with extremely strong market positions and an economic moat. Moody’s, for example, is a long-term investment by Warren Buffett (read about Warren Buffett’s latest portfolio here).

2. Finance Sector Investments: Moody’s, S&P, and Visa

The finance sector, with 39.5% of the total portfolio, is Hohn’s largest sector, and there were no changes vs. the prior quarter (September 30, 2024). Three of Chris Hohn’s top five investments are in the finance sector: Moody’s (number 2), Visa (number 4), and S&P (number 5). While Visa is a household name in the US, Moody’s and S&P might not be as well-known, even though these two companies are practically immune to competition.

Chris Hohn’s Portfolio & Changes – Finance Sector Only

Source: TCI Fund Management 13F SEC Filing

Visa needs no introduction—it’s a global market titan with a strong economic moat, and is well known by consumers and investors alike.

Visa Inc. (V)

Source: https://stockanalysis.com/stocks/v/

On the other hand, Moody’s and S&P are global leaders in the niche of credit rating services for governments and corporations, and are well-known mostly only to those who worked in investment banking or invested in corporate or government debt securities.

So, what do Moody’s and S&P do? Well, let’s explain using FICO credit scores as an example. If you're an American, you're likely familiar with the FICO credit score—everyone has one! The higher your score, the greater your creditworthiness, and the easier (and cheaper, thanks to lower interest rates!) it is to get a credit card, mortgage, or car loan.

Moody’s and S&P perform a similar function for governments and corporations worldwide, assigning credit ratings from the absolute best (AAA – S&P, Aaa – Moody’s) to the worst just above default (C – S&P, C – Moody’s). While there are other credit rating agencies out there, they pale in comparison to the might of S&P and Moody’s. The dominance of S&P and Moody’s is so compelling that if you’re a debt issuer (corporate or government) and choose to go with a lesser credit agency without involving at least one of these two giants, it raises eyebrows and sparks questions amongst savvy investors.

Moody's Corporation (MCO)

Source: https://stockanalysis.com/stocks/mco/

Warren Buffett is a large, long-time investor in Moody’s. With $11.6 billion invested in Moody’s, Moody’s is Warren Buffett’s 7th largest position. Click here to read more about Buffett’s latest portfolio changes. Another big investor in Moody’s is BlackRock, with roughly $6.7 billion invested in Moody’s.

S&P Global Inc. (SPGI)

Source: https://stockanalysis.com/stocks/spgi/

S&P and Moody’s are both global market leaders. BlackRock owns about $13.2 billion of S&P.

3. Industrial & Technology Sector Investments: GE, Microsoft, and Google

Chris Hohn has trimmed his largest investment, General Electric (GE), by 4.5%. Yet, GE continues to stand tall as Hohn's top holding. Meanwhile, he dialed back his sixth-largest investment, Google (GOOG), by 1.8%. In a surprising twist, he pumped up his third-largest investment, Microsoft (MSFT), by an impressive 16.7%!

Chris Hohn’s Portfolio & Changes – Industrial & Technology Sector Only

Source: TCI Fund Management 13F SEC Filing

When it comes to sectors, technology (GOOG, MSFT) is now Chris Hohn's second-largest sector, while the industrial sector (GE) is his third-largest investment.

Over the past 25 years, General Electric (GE) has undergone significant changes, evolving from a diversified industrial giant to a more focused entity. Founded in 1892 through the merger of Thomas Edison's Edison General Electric Company and the Thomson-Houston Electric Company, GE initially concentrated on electrical products. It later expanded into a major industrial powerhouse, making substantial contributions in aviation, healthcare, and energy.

However, GE faced challenges over the last quarter-century, leading to divestitures and a strategic decision to split into three independent companies: GE Healthcare (GEHC), GE Vernova (GEV), and GE Aerospace. GE Aerospace, which retains the legal name General Electric Company, is the successor entity and continues to trade under the "GE" ticker. It is a leading provider of jet and turboprop engines, as well as integrated systems for commercial, military, business, and general aviation aircraft.

Four big companies make up 99% of the global aero engine market: Rolls-Royce, Pratt & Whitney, CFM International, and General Electric. CFM International is a joint venture between General Electric and Safran Aircraft Engines (headquartered in Cincinnati, Ohio). If you add up GE and CFM, the joint global market share of GE-involved companies is about 53%, making GE the number one global leader in the global aero engine market.

Source: https://www.aerotime.aero/articles/32417-who-are-the-world-s-largest-aircraft-engine-manufacturers

As for GOOG (GOOG) and Microsoft (MSFT), one of the hottest areas in the technology sector is artificial intelligence (AI), and Google as well as Microsoft are constantly listed among the top 10 leaders within this rapidly evolving space. By market cap, Google and Microsoft are the 3rd and 4th largest AI companies, after Apple and NVIDIA.

Source: https://companiesmarketcap.com/artificial-intelligence/largest-ai-companies-by-marketcap/

Of course, this field is still young, and as DeepSeek (a Chinese AI company) has shown, there is the potential that the final winner won’t be a current market leader. Time will tell. But as of now, Microsoft and Google are proven performers and market leaders in that field.

4. Foreign Investments: Canadian Pacific, Canadian National Railway, and Ferrovial SE

Among Chris Hohn’s 9 investments, his top 6 investments are with US companies. The remaining 3 investments are divided into 3 foreign companies: 2 large investments in Canadian rail companies (CP, CNI) and one small investment in an EU company (FER). Hohn reduced his investment in CNI by 16.2% and increased his small investment in FER by 1.2%.

Chris Hohn’s Portfolio & Changes – Foreign Investments Only

Source: TCI Fund Management 13F SEC Filing

As for the Canadian rail companies (CP, CNI), both are critically important for Canada. It is easy to overlook, but Canada is the 2nd largest country in the world (with Russia being the largest country). Much of Canada is located in the cold north and is subject to bad weather for a big part of the year, so railway transport plays a critical role in Canada.

Canadian Pacific Kansas City (CP)

Source: https://stockanalysis.com/stocks/cp/

Canadian National Railway (CNI)

Source: https://stockanalysis.com/stocks/cni/

“Canadian National Railway (CN) and Canadian Pacific Railway (CP) are the two dominant freight rail operators in Canada and are both Class I railways, meaning their revenues exceeded $250 million in the past two years.

Out of the total Canadian rail transport industry revenues, CN accounts for over 50% and CP for approximately 35%.”

Source: https://railwaysuppliers.ca/english/industry/industry-information.html/industry-statistics

A good way to look at both companies is essentially as a local utility company without a serious competitor.

5. Summary & Key Investment Insights

Chris Hohn is praised as a top hedge fund manager by Institutional Investor. With an impressive $42 billion invested in just nine companies, Hohn's strategy revolves around concentrating his capital in a select number of high-potential stocks rather than spreading it thinly across the market. This philosophy echoes the wisdom of investment legends like Warren Buffett, who famously said that diversification is often a hedge against ignorance.

So, what can we take away from Chris Hohn’s recent moves? Here are a few key insights:

Concentration Over Diversification: Chris Hohn’s success underscores the value of high-conviction investing in a select number of companies with strong fundamentals. His portfolio of just 9 companies—including Microsoft (MSFT), General Electric (GE), Moody’s (MCO), Visa (V), and Canadian National Railway (CNI)—demonstrates that less can be more when you invest in the right businesses, and ONLY if one knows what one is doing..

Focus on Quality: Hohn’s portfolio is built around market leaders with strong economic moats and recurring revenue streams. Examples include:

o Microsoft (MSFT) and Google (GOOG): Leaders in AI.

o Moody’s (MCO) and S&P Global (SPGI): Dominant players in the credit rating industry.

o Visa (V): A global payments giant with a strong competitive edge.

o General Electric (GE): A leader in aerospace through GE Aerospace and CFM International.

o Canadian Pacific (CP) and Canadian National Railway (CNI): Critical infrastructure players that provide essential services in Canada’s freight rail industry.

Geographic Balance: While heavily weighted toward the US (e.g., Microsoft, Visa, Moody’s), Hohn’s portfolio includes select international opportunities like Canadian Pacific (CP), Canadian National Railway (CNI), and Ferrovial (FER). This balance helps mitigate risks and capture growth across different regions, and reveals his global pursuit of solid companies, particularly in industries that provide essential services.

Thank you for reading the article. Hope you enjoyed it.

Hungry for more? Subscribe to the newsletter - it's free and fabulous.Enjoyed this article? Don't keep it to yourself! Share it with a friend or two. They might even buy you a coffee as a thank you.Your Fringe Finance

Disclaimer

Neither the author nor Fringe Finance is a financial advisor or a tax professional. This article is for illustrative and educational purposes only and does not constitute a specific offer of any product or service.

Past performance of stocks and assets is not an indicator or guarantee of future performance of stocks and assets.

The information in this blog does not constitute an offer to buy or sell, or a solicitation of an offer to buy or sell, any of the securities mentioned herein.

We believe the information provided is accurate and current. However, we do not guarantee its accuracy and it should not be considered a complete analysis of the topics discussed.

Any opinions expressed reflect the author's judgment at the time of publication and are subject to change.

Seek guidance from qualified financial and tax experts before taking action.

I like the read, but why are ypu saying that the S&P global isn’t known?! Literally every finance yt: buy the s&p 500. They may not know the company, but they know the index 🤣🫡

Good stuff. Thanks for breaking down his latest 13-F.