It is tough to make predictions, especially about the future.

— Yogi Berra

We certainly live in interesting times. Legendary investor Jim Rogers sold all his US equity. In fact, he sold all his equity worldwide, except for his equity investments in China and Uzbekistan. Yet Rogers is still very bullish on gold and silver, as well as a few other investment opportunities. More about all this, except Uzbekistan, below.

But Jim Rogers is not the only one getting out of Dodge. Legendary investor Warren Buffett (click here) reduced his investment in US equity significantly and moved into cash/US Treasury in a big way. Legendary investor Michael Burry (click here) shifted his investments from the US to China in a big way. The CEO of the world’s largest sovereign wealth fund, the $1.7 trillion Norwegian oil fund, recently said (click here) in January 2025:

“The best thing to do is always to do the opposite of everybody else. What will that be today? Well, if you were to do the opposite of everybody else, it would be to sell US tech stocks and buy China,...”

Yet other legendary investors like billionaires Chris Hohn (click here), Bill Ackman (click here), and Andreas Halvorsen (click here) are still heavily invested in the US, although less in the Magnificent 7, except for a few select Magnificent 7 members.

There seems to be a sense that whatever was the case in recent years won’t most likely continue to be, and that much is changing. Why? What changed? What are the factors causing concerns, and what is driving Jim Rogers to his decisions?

Let’s take a look.

1. Selling US Stocks: A Sign of Caution

In a recent interview on March 16, 2025 on Mint Money Talks, Jim Rogers said:

“I have sold US stocks because I think America is going to have problems. America has not had a serious problem since 2008. That's the longest in American history, so I expect America to have problems. Whether it's Mr. Trump or anybody else, America's overdue for a problem, and we're going to have a problem.”

“Well, we're going to have economic problems. We have not had a recession for the longest period in American history. It’s been 15 or 16 years. We have never gone that long without a problem. So in my view, we're going to have inflation problems, economic problems, economic slowdown, recession... inflation. We're going to have various problems.”

“Well, I would suspect that the recession is going to be the worst in my lifetime because it’s been so long since we’ve had a very serious recession in the US, and it’s probably going to be very bad because we haven’t had a very bad recession in a very long time. So I don’t like it, but we’re overdue, and we’re going to have a serious recession.”

You can watch the whole interview here:

Jim Rogers may be right or wrong. Jim Rogers tends to have an above-average hit record, but no one is perfect. So, what about his arguments? Let’s take a closer look.

US Stock Market (S&P 500) and Recessions

Below is a graph of the S&P 500 index going back the last 30 years. The grey areas show a recession. If you ignore the mini-recession during COVID (2020), the last serious recession was from 2007 to 2009 (circled in red).

Since then, the S&P 500 index has gone up from about 1,000 to about 6,000 (a six-fold increase). Does it mean that a recession is 100% incoming? No, but based on historical data, recessions typically happen after every so many years, and we haven’t seen one for a very long time now. Based on this, the recession risk is certainly high. Inevitable? No. High? Yes.

Source: https://www.macrotrends.net/2324/sp-500-historical-chart-data

An argument might be made that much of the recent S&P 500 growth is due to the Magnificent 7 (Mag 7: Apple, Microsoft, Amazon, Google, Tesla, Nvidia, and Meta). And if you compare the P/E ratio of the S&P 500 (which includes the Magnificent 7) to the P/E ratio of the S&P 500 without the Magnificent 7, much of the risk seems to be located within the Magnificent 7. Either way, it has been a long time since the last recession.

Does this mean we will see a recession this year? Who knows? But one thing is certain: Jim Rogers is concerned enough to sell his US stocks. With this, Jim Rogers is moving in the same direction as Warren Buffett, only more extreme. Buffett sold a large chunk of US stocks and moved it into cash.

Warren Buffett’s Berkshire Hathaway – Invested Portfolio vs. Cash Position

Source: https://ffus.substack.com/p/warren-buffett-sells-banks-keeps

And Warren Buffett’s cash position is now at a record high.

Berkshire Hathaway – Cash Position in $ Billion

Source: https://ffus.substack.com/p/warren-buffett-sells-banks-keeps

But, as mentioned in the introduction, Jim Rogers not only sold his US equity investments; he sold all his equity investments worldwide, except for his investments in China and Uzbekistan.

Starting at time code 1:50, in the following video from March 31, 2025 with Professor Glenn Diesen, Jim Rogers said:

“I have sold out everywhere except China and Uzbekistan because nearly everybody is doing well, and whenever that has happened in the past, it has often led to problems. Everybody cannot be happy all the time. Well, maybe they can be, but it doesn’t last very long. So I would suspect we’re going to have a recession soon, and it probably will be very serious because it’s been so long without a problem.”

So, if that is the case, what is Jim Rogers doing with his money, and where does he still see investment opportunities? In a nutshell, he sees opportunities in China, gold, silver, and at some point in the future India, and he keeps extra liquidity in US dollars. Let’s take a look.

2. Jim Rogers Continues to Invest in Gold and Silver

In the above-mentioned recent interview on March 16, 2025 on Mint Money Talks, Jim Rogers said:

“I hope that I’m smart enough to buy more gold if it goes down some more, and I certainly hope I buy some more silver. Silver’s already down, and I hope that I’ll be buying some more silver soon and some more gold.”

“I want to buy more of both, and I suspect they will continue to go up and that will be a good place to invest.”

That is more or less in line with what Jim Rogers had said earlier in the article “Jim Rogers Buys Silver,” where he said:

“Everybody should own gold and silver. If I were buying one today, I would buy silver because it's cheaper.”

The above article also talks about the all-important Gold-Silver Ratio, historical silver prices, and how to invest in silver.

Metals are only a part of my investment portfolio, but it is interesting to see how many legendary investors in that space are getting almost giddy. Legendary gold and silver investor Rick Rule recently said, “You have no excuse, not to make a million or two, in this market,” and he shared the 22 mining stocks he owns in 2025.

You can read about it and how to invest in gold and silver (physical, ETF, miners with all the pros and cons), including which 22 mining companies Rick Rule owns in the following article “Legendary Gold and Silver Investor Rick Rule: “You have no excuse, not to make a million or two, in this market”.”

3. Jim Rogers Continues to Hold US Dollars

In the above interview with Professor Glenn Diesen, Jim Rogers was asked which currencies he currently owns. Basically Glenn Diesen wanted to know, other than the investment in China, Uzbekistan, gold and silver, where do you keep your money. Jim Rogers said:

“I'm mainly in US dollars, and I own US dollars because when people get worried, they usually turn to a safe haven, and many people in the world think the US dollar is a safe haven.”

“It’s not, but people think it is for historic reasons, so I own US dollars mainly.“

In a nutshell, Jim Rogers seems to believe that if you need to store value temporarily in a liquid form, the US dollar currently beats all other currencies. Not that he believes that the US dollar will continue to be a strong currency, but if there is a recession, a global recession, investors from all over the world will park their money in US dollars as they perceive it to be a safe currency, which will drive the value of the US dollar up. The expression “the cleanest shirt in a pile of dirty shirts” probably describes Jim Rogers' thinking best.

4. Investing in China – Still There, For Now

In his interview with Professor Glenn Diesen (see above), Jim Rogers said the following about China:

“China can have problems too, don’t get me wrong.”

“I do own my Chinese shares still because I would expect that they will do better when the recession comes. China can have problems too, but I still own my Chinese shares because they’re not as expensive as other countries.”

“You can ask me next month or next year, but at the moment, I still own my Chinese shares.”

The way I interpret what Jim Rogers is saying is that while he hasn’t sold his Chinese investments yet, he may hold onto them or not. Probably, since on a P/E risk basis (based on P/E ratio), Chinese stocks are not as risky as US stocks.

Take the two global leaders in the EV car market – Tesla (US) and BYD (China) – for example.

Tesla is currently (as of April 3, 2025) trading at a P/E ratio of 132, while BYD is trading at a P/E ratio of 25. If there is a global recession, stocks with a high P/E ratio have much more downside potential than stocks with a low P/E ratio. I am not saying that Tesla will or will not do well in the years to come. This is just a P/E-based risk assessment.

As for China, if you want to learn more about it, back in December, I wrote the article “China: Legends Are Investing - Are You? China: Known to Many, Yet Still Unknown to Some,” where I said, “China, depending on how you measure it, is the 2nd largest or largest economy in the world. China’s economy is 4 times that of Germany or Japan. Its manufacturing capacity is larger than that of the US and EU combined. Legendary investor Michael Burry, famous for predicting the 2007 subprime crisis, has recently ramped up his investments in China significantly.”

5. Investing in India – Not Now, But Monitoring

In the recent interview on March 16, 2025 on Mint Money Talks, Jim Rogers said:

“I’m optimistic about India for the first time in my life. I've been optimistic at times in India and China before, but now I really think that the people in Delhi understand that you have to have a sound economy and prosperity.“

“They used to say it, but now I think they understand it.”

“I’ve invested in India before, but never with a lot of enthusiasm. Now, I have enthusiasm when the prices are down.”

“Indian stock markets have not... are not down enough for me yet to buy. You know, the Indian market made new all-time highs recently, so I want to buy India but not yet.”

“Well, you know, market timing is extremely important and difficult. I hope that if market timing goes down, if prices go down, that I’m smart enough to buy Indian shares. Not yet, but I hope later.”

In a nutshell, Jim Rogers is eager to invest in India, but he is expecting the stock market in India to come down. And like the smart investor that he is, he waits until the thing he wants is on sale. No need to rush.

The world has changed. Not only is China now the world’s second-largest economy, but India is now the world’s fifth-largest economy. India’s economy is now larger than the economies of the UK, France, or Italy. Quite a change from just a few decades ago.

World Bank – Top 10 Countries Ranked by GDP (US dollar)

Source: https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?most_recent_value_desc=true

There are two major stock exchanges and corresponding stock market indices in India:

Bombay Stock Exchange – BSE (SENSEX): Established in 1875. The major BSE stock market index is called Sensex and covers the top 30 blue-chip firms. On a side note, just FYI, the city name of Bombay changed to Mumbai in 1995. However, the index name “BSE,” even though the origin of the acronym "BSE" referred to Bombay, remained unchanged.

National Stock Exchange – NSE (NIFTY 50): Established in 1992. The major NSE stock market index is called Nifty 50, which tracks 50 large-cap companies.

Both indices have grown dramatically since the early 2000s. Jim Rogers is eager to invest, but as he appears to be expecting a sell-off (recession), he is waiting for a good entry point into India.

BSE SENSEX Index

(Indian Rupee – INR)

Source: https://in.tradingview.com/symbols/BSE-SENSEX/

NSE NIFTY 50 Index

(Indian Rupee – INR)

Source: https://in.tradingview.com/symbols/NSE-NIFTY/

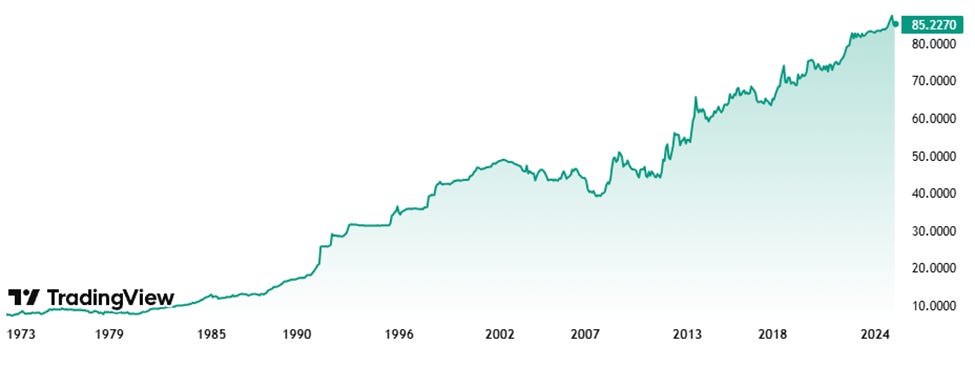

Of course, both stock index graphs are expressed in the local currency (Indian Rupee – INR), and the Indian Rupee has been losing value against the US dollar since the early 2000s. In the early 2000s, 1 USD would buy you about 40 INR. Today, it buys you 85 INR, meaning the value of the INR vs. the USD roughly halved.

US Dollar – Indian Rupee Exchange Rate

Source: https://www.tradingview.com/symbols/USDINR/

But given how much the stock market in India has increased since 2000 (SENSEX: increased from 10,000 to about 80,000 and NIFTY 50: increased from about 4,000 to about 24,000), even after converting it to USD, these are amazing returns.

There are multiple ETFs that allow you to invest in the Indian stock market that trade on the US stock exchange. If you’d rather do stock-picking of individual Indian companies, the largest sovereign wealth fund in the world has already screened a number of stocks, which is a good starting point. These Indian stocks can be found in the article “Inside Norway’s $1.7 Trillion Wealth Machine.”

6. Summary

Legendary investors earn their reputation because they tend to be very successful over time. No one gets it right all the time, and we all have our biases. That said, here’s what I took away from Jim Rogers' perspective:

A Global Investment Perspective: Jim Rogers lives in Singapore and has traveled the world twice (not just Europe), so he has a truly global view on investments. This extensive travel helps him spot opportunities that others might miss. Knowledge is a funny thing - once you learn something, you know, but not before. But before you learn it, you might not even realize what you are overlooking. For example, an investor who only looks at their local market may not see the potential in fast-growing areas like India or Southeast Asia, while Rogers, with his wide-ranging experiences, can easily recognize those opportunities. However, in my opinion, this does not mean that there are no good select investment opportunities in the US or Europe, for example. It just means that, from Jim Rogers' global perspective, he has bigger fish to fry.

Sold US Equity Investments, but Kept China and Uzbekistan: He’s worried about a global recession and the stock market declines that usually come with it. Because of this, he has sold off all his stock market investments worldwide, including in the US. The only exceptions for now are China and Uzbekistan, but that could change.

Staying in China: For now, China is still a good option for him because it has a lower risk profile with lower P/E ratios compared to US companies.

Buying Gold and Silver: Jim Rogers continues to invest in gold and silver.

Holding Cash in USD: According to Jim Rogers, no fiat currency seems to look great right now, including the US dollar. However, perception matters. If a global recession hits, which he believes is likely, investors around the world will likely shift their money into what they see as a safe-haven currency—the US dollar. This will probably increase the value of the dollar, making it cheaper for him to invest in non-USD markets like India.

Eager to Invest in India, but Not Yet: Jim Rogers said that he is eager to invest in India, but he’s holding off for now. He’s optimistic about the Indian government’s actions and wants to invest, but he’s waiting for the stock market to drop so he can buy Indian stocks at a discount.

Thank you for reading the article. Hope you enjoyed it.

Hungry for more? Subscribe to the newsletter - it's free and fabulous.Enjoyed this article? Don't keep it to yourself! Share it with a friend or two. They might even buy you a coffee as a thank you.Your Fringe Finance

Disclaimer

Neither the author nor Fringe Finance is a financial advisor or a tax professional. This article is for illustrative and educational purposes only and does not constitute a specific offer of any product or service.

Past performance of stocks and assets is not an indicator or guarantee of future performance of stocks and assets.

The information in this blog does not constitute an offer to buy or sell, or a solicitation of an offer to buy or sell, any of the securities mentioned herein.

We believe the information provided is accurate and current. However, we do not guarantee its accuracy and it should not be considered a complete analysis of the topics discussed.

Any opinions expressed reflect the author's judgment at the time of publication and are subject to change.

Seek guidance from qualified financial and tax experts before taking action.

In recent weeks, a subtle but powerful signal has emerged: the long-standing correlation between the U.S. dollar and global risk aversion appears to be shifting. Following what markets dubbed “liberation day,” the dollar weakened sharply against major currencies; most notably, the euro. This move was unexpected. Reserve status is not a birthright. It comes with stringent, often overlooked requirements.

Good read! For me, Tesla and BYD aren’t really comparable. Tesla’s high valuation isn’t just about car sales. Its revenue comes from multiple segments, including energy, software, and autonomous tech. The "crazy" valuation some criticize is tied to the potential of robotics and AI, which could reshape several industries.

Jim Rogers' outlook is definitely worth paying attention to. He seems particularly pessimistic about the economy, predicting a serious recession. As for gold, traditionally, it’s used as a safe haven asset during recessions. It tends to rise when markets are uncertain, as investors flock to it for stability. It’s important to remember that gold’s value often increases during economic downturns because of its role as a hedge against market volatility.